Buy call 7400 for 10% notional + sell NQU8 for 7% of NAV

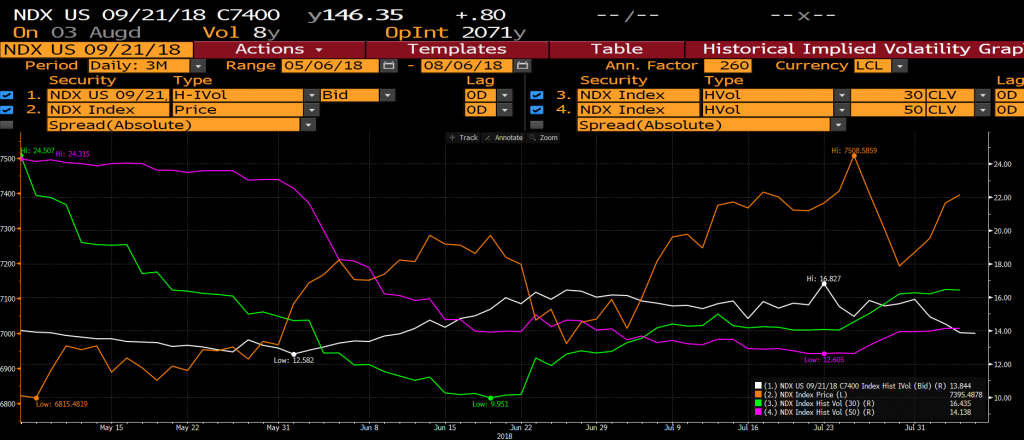

Implied volatility on the Nasdaq (see figure below white line) is back to its low range: We close it 2 vega above at the end of June. At 13.85%, it is even below the 30 (14.14%) and 5o days realized volatility (16.43%):

figure 1: Implied volatility of the NDX US 09/21/18 Call 7400 (white line) with 50 days realized volatility (green line)

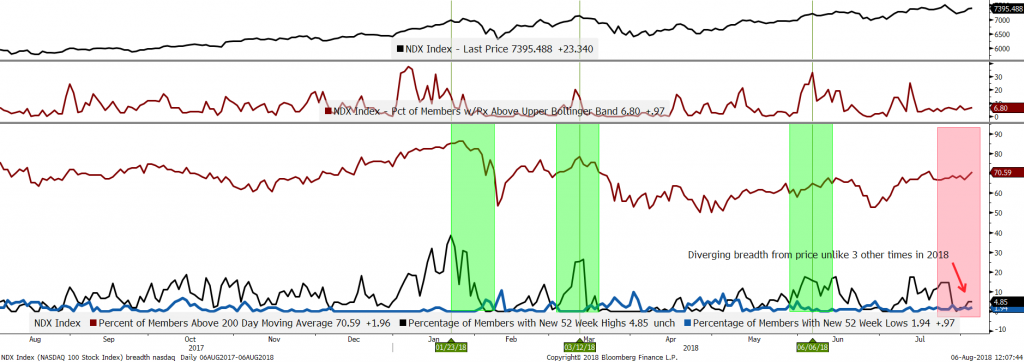

While our US matrix is still overweight Technology, technical indicators like poor breadth, too few new highs and diverging RSI (please find a chart on Nasdaq in the CharTatans space) encourage us to re-initiate a long gamma trade on Nasdaq by purchasing a call with a short on september future for a net short 2% of NAV.

Figure 2: while NDX reaches new highs, the % of members with New 52 week Highs is low like the % abobe their upper bollinger band

Tech accounted for 65% of the S&P 500’s gain YTD going into last week (55% now), near the post Tech-bubble highs and at an unsustainable pace (Tech’s weight in the S&P 500 is ~26%, also a post Tech bubble high). The fact that Tech is so large and represents such a significant proportion of the ‘winners’ makes contagion from a positioning unwind more likely now than ever. Notably just five companies, Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN) and Facebook (FB), now account for over $3.5 trillion of market capitalization. To put this in perspective, this is more than the sum of over 2,200 companies in the Russell 3000 Index (the 3,000 largest publicly-traded US stocks). A different measure of breadth, the percent of stocks moving more than the S&P 500, is near 14 year lows, indicating an increasingly small proportion of stocks are driving the overall market – note that weak breadth has been a negative signal for both the market and Tech vs the market historically.

If these Tech stocks crack, there will be much less support for US equities. As many felt with FB last week, you can’t have a >$100bn loss in a well-held name and not have collateral damage. Yet, there is still no willingness from HFs to take down long tech exposure yet…the flows have exhibited a lot more hedging than outright selling. The team also found that even while Tech ownership is high, we are just off the lows for both Net and Gross exposures. So broadly, there doesn’t seem to be a sense of over-exuberance in this market.