EUR/USD is at its right price based on 5 year inflation expectation differential...

USDJPY (black), versus liquidity (red)

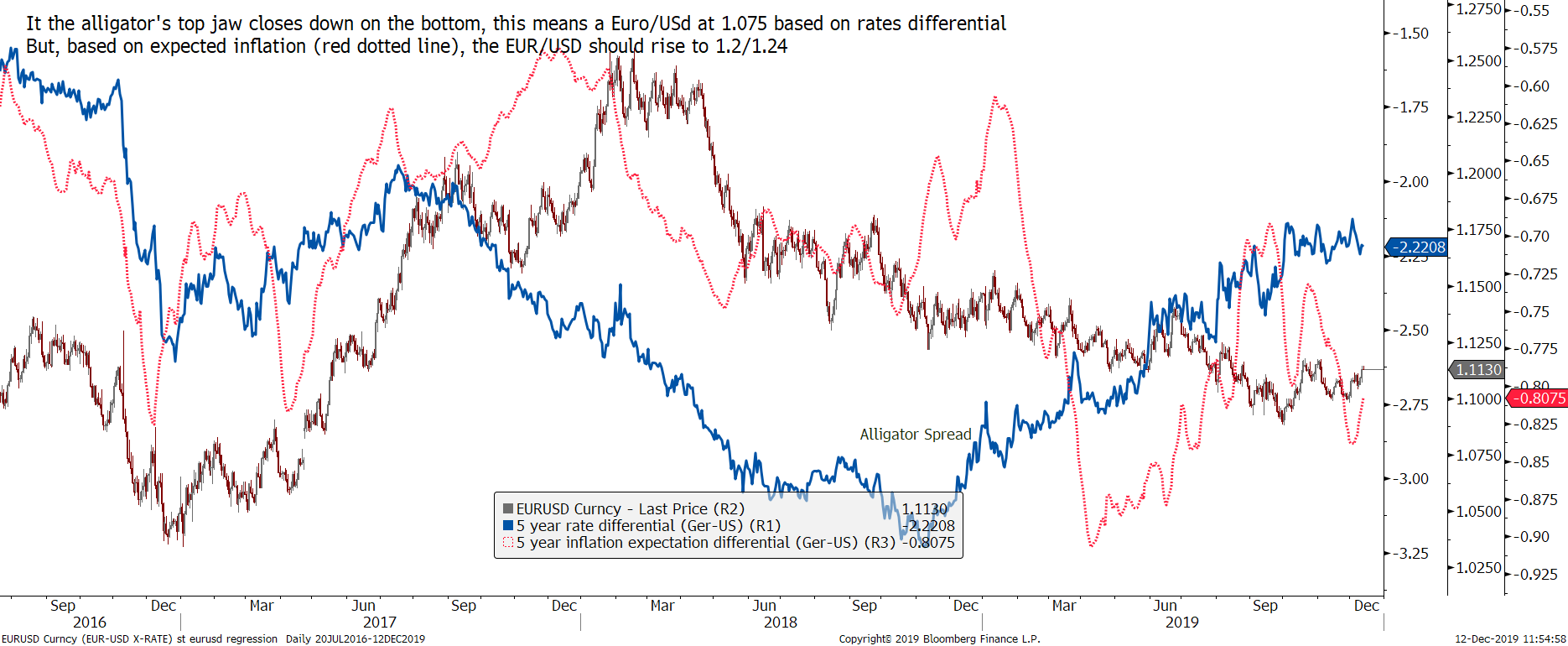

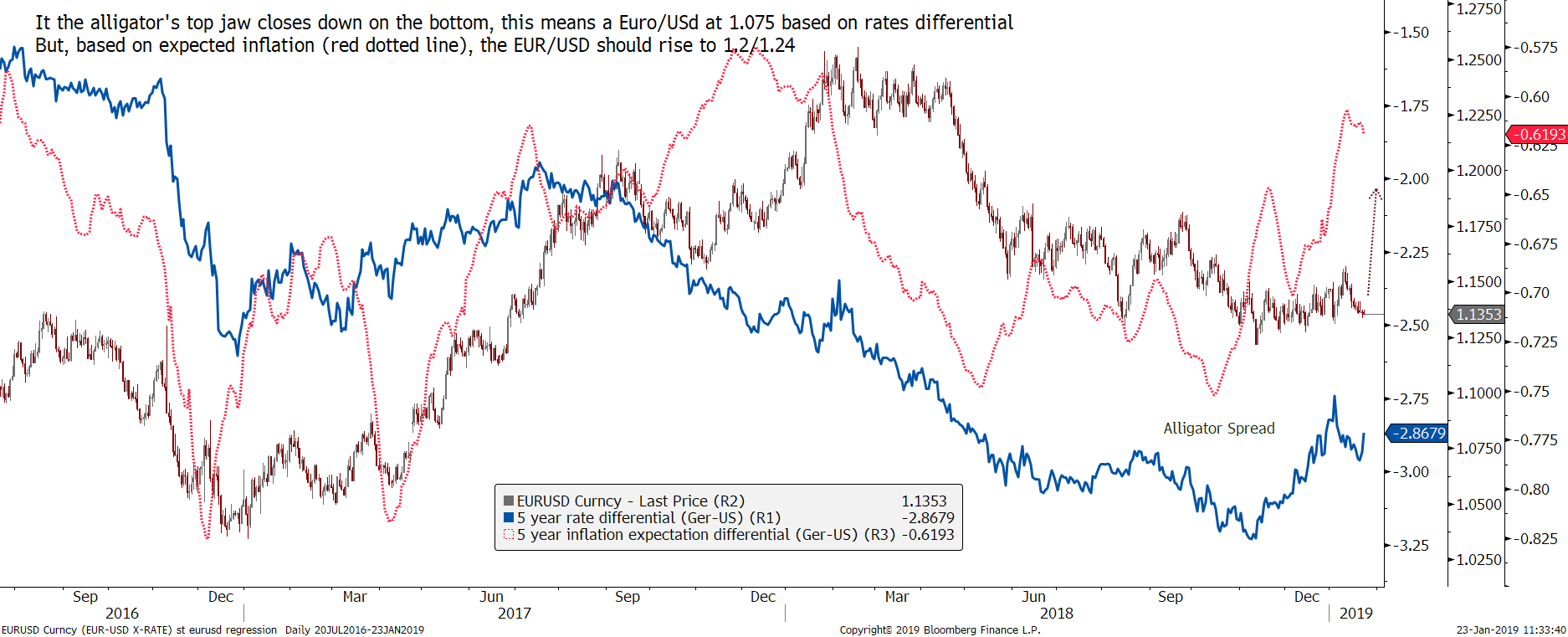

EURUSD (candle), the German-US Inflation expectation spread (in red), the 5 year interest rates differentiel (in blue)

A lot of people thought that the dollar would go up because the Federal Reserve is planning on raising interest rates while other central banks are not. This misses the fact that there is no correlation between short-term central-bank behavior and the dollar. The correlation that does exist is between what the market thinks the Fed is going to do about 18 months ahead and how the dollar moves. As expectations change toward the end of this year and into 2020, they will likely correlate with the dollar’s move to the downside. The Fed predicted four federal-funds rate increases of 25 basis points [0.25 percent] in 2018, and for a while the bond market was skeptical, but the Fed won out and executed on its plan. But now, Fed members forecast two rate increases in 2019, and the market is expecting virtually none. I think the Fed is already showing signs of capitulation, and so it’s likely that the dollar will go down. Also, there is a massive bullish position in the dollar; it has existed since the summer. The bullish position is now the same as it was in late 2016, just before the initial big decline in the dollar from its peak. Also, a weak dollar correlates extremely strongly to rising budget deficits and trade deficits. Just to refresh your memory, our national debt went up to $22 trillion at year-end 2018. It was at $21.5 trillion three months earlier. It was at $20.2 trillion a year before. So that is definitely in the mix.