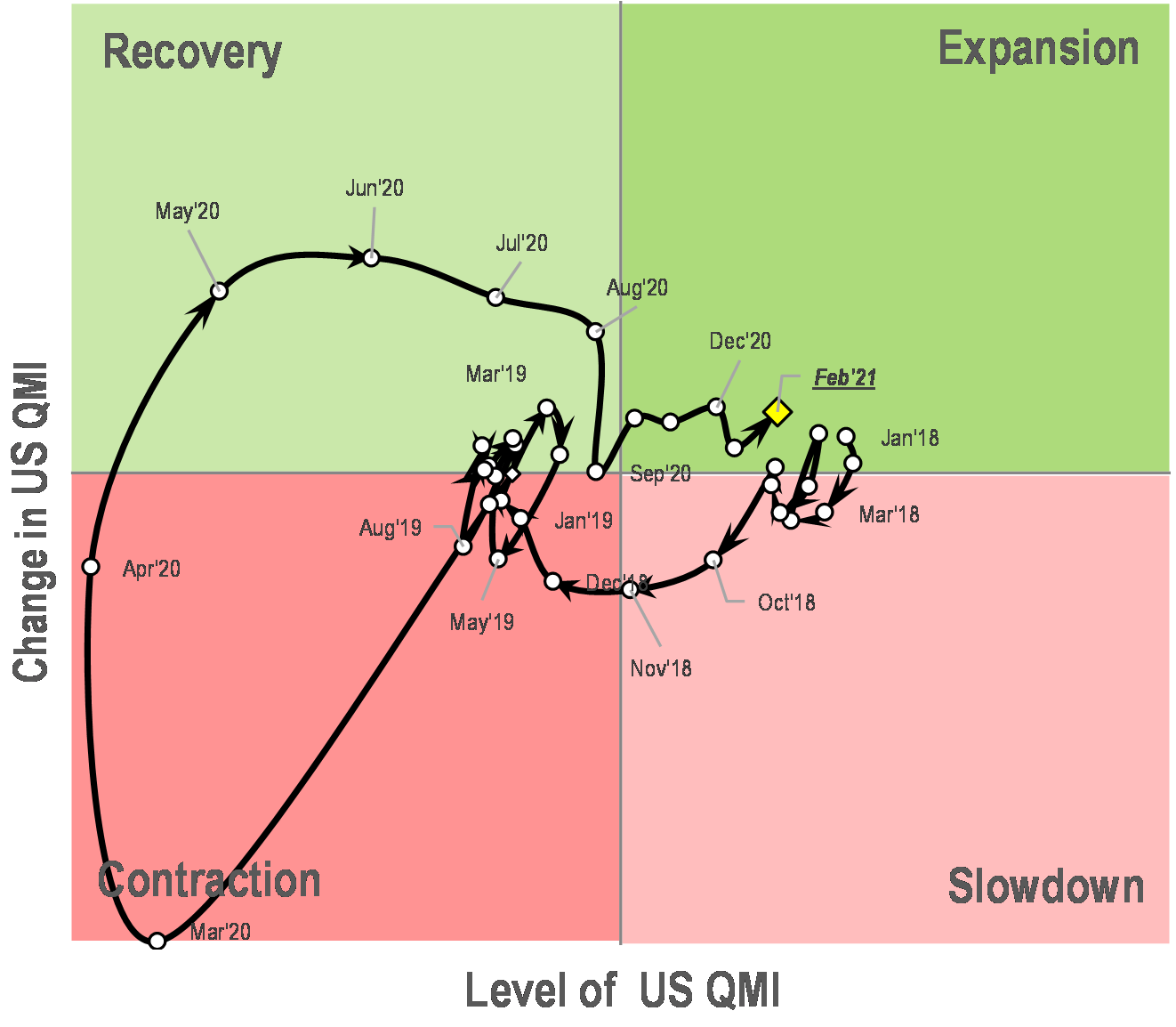

Our Economics grade is built with three parameters.

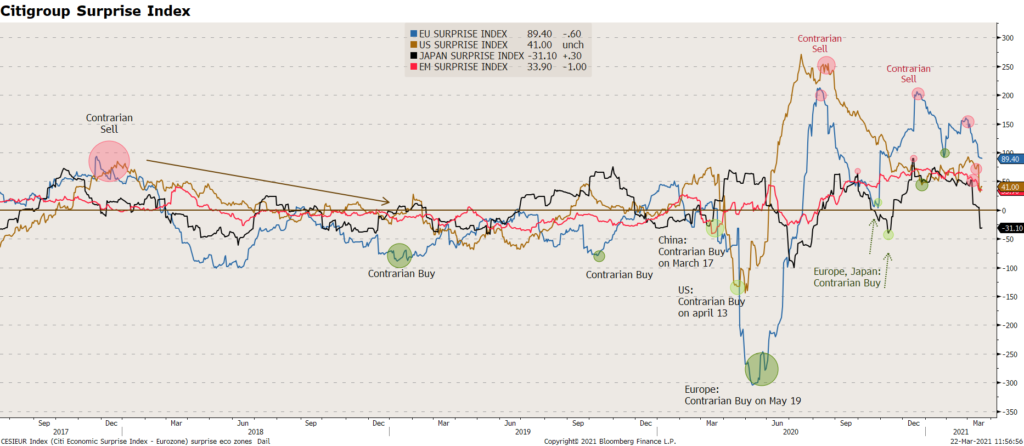

the Citigroup economic surprise index, which measures data surprises relative to market expectations.

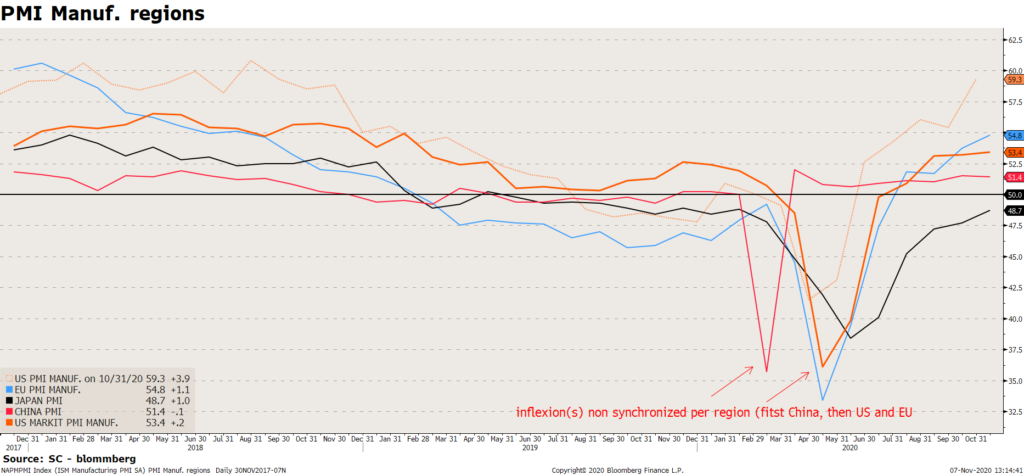

Manufacturing PMI

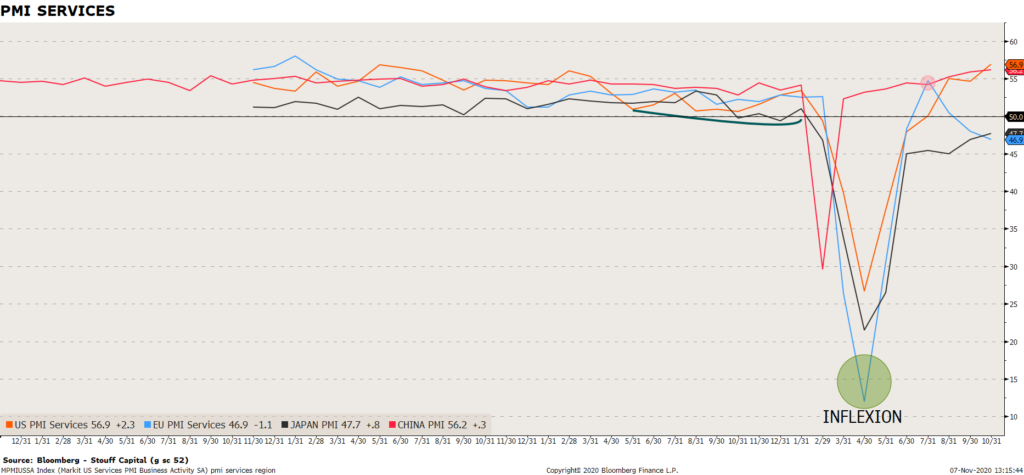

Services PMI

Elevated

The profits recession is more a function of the business cycle overheating than most appreciate, which means labor markets may soften further along with capital spending until the profits recession ends which is unlikely after just one quarter of modestly negative growth. It also means there probably isn’t as much slack in the economy as many investors think and as depicted by the cost pressures now evident. Rather than Goldilocks, perhaps we should be talking about Hansel and Gretel – a fairy tale about the dangers of an unwholesome appetite as a means of survival – i.e., chasing prices higher and justifying it with the wrong narrative.

| m: | U.S. Household net worth rose |

| U.S. Household net worth rose at an 8.X% rate in Q3 to a $109.X tln record-high, from a $106.9 (was $106.9) tln prior record-high in Q2, according to the Fed’s Z.1 report. Analysts expect a 1% contraction rate in net worth in Q4, given the stock price pull-back that should allow an 1% asset value drop after the 8.X% Q3 increase, alongside an assumed 4% liability rise after the 3.X% Q3 climb. Net worth in Q3 sat 99X% above the $55.0 tln cyclical-trough in Q1 of 2009. Asset value growth in Q3 included an 8.X% growth pace for real estate, and an 8.X% growth pace for financial asset values. Total liabilities are still just 17.X% above the $13.6 tln cycle-low in Q1 of 2012 that marked a hefty 7.0% decline from the $14.6 tln cycle-high in Q3 of 2008 that analysts have yet to exceed. Before this cycle, outright drops in liabilities were rare, as analysts last saw a quarterly liability decline in Q1 of 1983 with a 1.9% drop. Before that analysts saw a drop in Q1 of 1975 of 0.5%. :theflyonthewall.com |