Let me take you back to the early 2000’s:

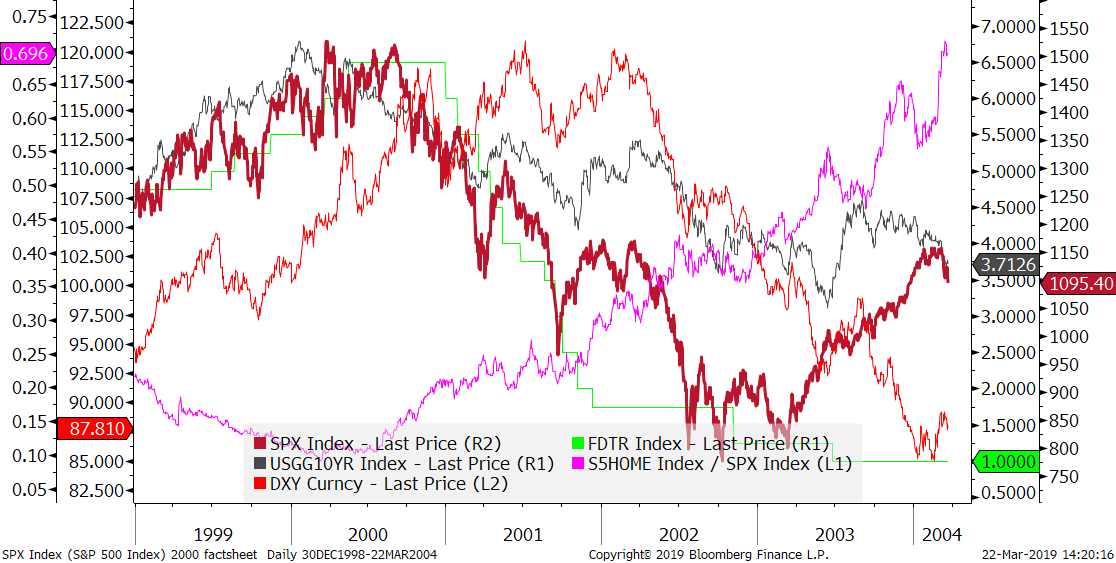

If you were there at the time, you may have noticed that the early market jitters didn’t prevent the Fed from moving forward with its tightening program:

Yields bear flattened (green FF tgt, grey 10Y yield) as SPX (dark red) softened.

In fact, you can make the generalization that whenever inflation fears make rising rates a necessity vs strong market performance, the growth outlook becomes grim.

Hence why I think of the 2000s vs today.

In fact, Alex Gurevich (read his book, it’s good) describes the historical pattern of the Fed’s policy at every cycle end:

1. We are overheating: hike!

2. Stocks aren’t the economy, stay the course.

3. Stocks are the economy. We’re watching the market closely.

4. Numbers are mixed: pause and resume.

5. Just one cut.

6. Low for longer.

It is easy to figure out at which stage we are right now.

But the final – and most important – takeaway from all this is this is that history suggests the beginning of an easing cycle is bullish for the Dollar.

Let’s go back to the chart above:

The Dollar bottomed in the fall of 2000, rallied for a couple of years and peaked after the easing cycle was over.

WHAT TO DO?

I want to focus your attention on two things for the rest of 2019: (a) Low Rates Play and (b) Bullish Dollar plays.

We will attack the first today.

[Next week, we’ll go over the combo low rates + bullish dollar plays (it’s easy, there is only one correct trade)]

US HOUSING

Post FOMC, the US homebuilding ETF did that:

The Fed “pivoting” is the catalyst for a sector which is already experiencing structural tailwinds: (charts below highlight the structural supply/demand drivers of the US housing markets)

Over the last 12 months, the group has sold-off materially due to a combination of : rapid rate rise + labor and materials inflation

So much so, that valuations have converged towards book value:

I have spent the this week with the management team of Toll Brothers (TOL) and from their pov, the single biggest factor that impacted demand last year was the combination of a rapid rise in rates AND home prices in their key markets:

For example, TOL’s biggest market is California. Between January 2018 and Nov 2018, the monthly payment for the same house went up 30% (mortgage+price)

Hence buyers who postponed their decision felt temporarily priced out of the market.

Today, the 30-year mortgage has come down and companies are already talking to buyers coming back in the market:

STOCKS

With the exception of two players (DHI and NVR), the income statements of these companies are balance-sheet driven.

Hence the evolution of rates has a big impact on valuation.

Going back to TOL shares trading at book, it means that they could liquidate their assets and still be up 25%-30% (they hold the land at cost and land prices are up 30% overall).

Not to say that they will but when you think about the current valuation context, I believe it is clear that your margin of safety is pretty decent here.

At the sector level, multiple ways to win:

A) Long ITB on any pullback

B) Long Homebuilders/Short Regional Banks

From a single stock perspective, the dominant trades are Lennar (LEN) – which is the beta play on housing – and DR Horton (DHI), which is a potential multi-bagger of the next 3 years.

DR HORTON (DHI)

DR Horton (DHI) – $40.54/sh ; 373.4m (sh outst) ; $47-$32.39 (52w range); $231.6m (ADV)

Company Background

DR Horton is the No1 homebuilder in the United States. It operates in 78 markets across 26 states. While dominant at the entry-level (expanding “Express” brand is key to the story), the company is broadening its product profile by increasing its exposure to low-end (“Freedom” brand), move-up and active adults buyers. Scale means relationships which mean being first to the best land units in every market. Current ROE is ~17%, 60% of their land is optioned, their balance sheet is considered the best in the biz at 20% net debt. They generate around $1.2B of free cash annually. On a market cap of $15b.

Investment Thesis

Shares of DR Horton offer one of the most asymmetric risk/reward in American cyclical stocks. Homebuilding is a risky business because of the need to hold land on your balance sheet. Last year, DR Horton acquired Forestar (FOR) – a TX based land developer – to transform into an “asset-light” business model. By doing this, the company will free up assets on its balance sheet and take cash generation even higher. DHI is already considered the most efficient builder (i.e. they make money on every aspect, including the vertical construction, which is very hard) but Forestar will allow them to move from 60% optioned land to ~75%. The diminished capital intensity, improved asset turns with equivalent margins should increase ROE to 30%. In light of the statistically significant relationship between ROE and P/B multiple, this should take the valuation from 1.5x currently to 2.5x.

Horton owns 75% of FOR. The goal is for FOR to access capital markets (both debt and equity) and dilute DHI’s holding to around 25% over time. This in turn will allow DR Horton to return cash to shareholders via buybacks (they shocked the Street by buying back 250M last Q).

Catalysts

a. FOR tapping capital markets to allow DHI to drop ownership stake from 75% to 35%. We expect something in the coming months.

b. They have to show that FOR is a land machine (consistent flow of sales of land, consistent operating margins, eventually sell land to other builders in instances when DHI isn’t interested)

c. Who’s going to buy this deal? Shareholders of DR Horton will buy FOR stock as an insurance policy (i.e. making sure this thing works!). Long Pond, Senator come to mind.

d. Large buyback thanks to $5.5B (cumulative) cash generation through 2021 ($3.7B through 2020).

Valuation

Cheap: 1.4X our estimated 2019 BV. About 1.6X is historical average and this is a better company by far, than in the past. PE is 8.5X vs 10.8X historical.

Looking at the historical relationship between ROE and P/B, there is exactly zero of this priced into the stock at $40.5.

Said differently, the stock should be worth around $50 (+33% upside) on its operating fundamentals alone.

In a bull case where the FOR deal plays out as expected, we think the longer term (2020-2021) fair value could range from $77 to $112.

Hence if FOR/DHI works, upside is 3x and if it doesn’t, fundamentals argue for 30-40% upside.

Risks

Capital markets shut down and / or macro entering into tail spin.

Stock is on breakout watch