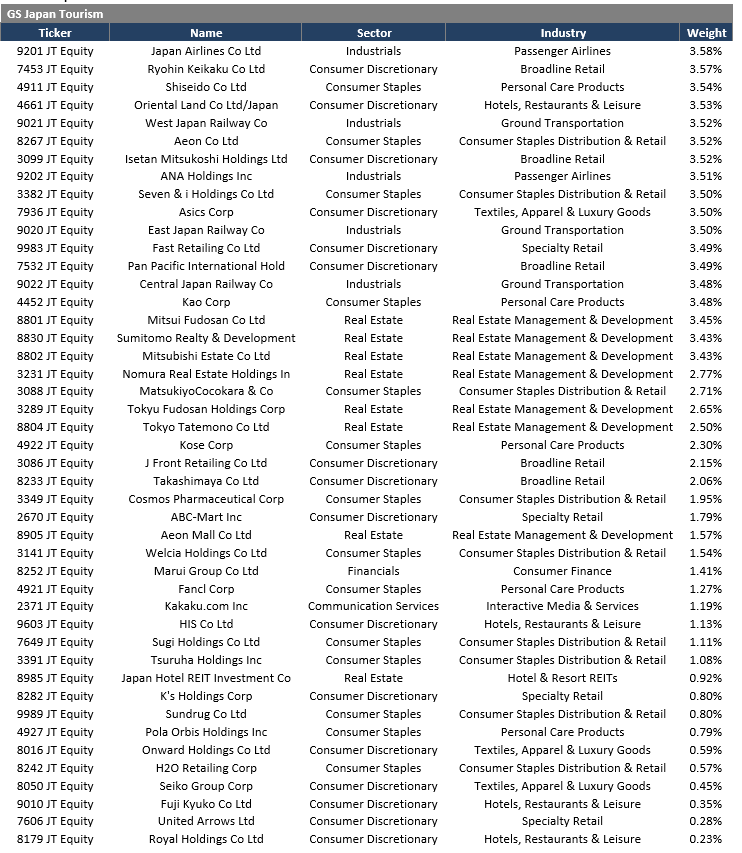

We have an issue on our Japanese portfolio. The underperformance in 2024 is too big. The process is under review. We are adding some Japanese tourism names , within the list below. With USDJPY breaking to levels last seen in 1990 post US CPIs last week, Japan inbound tourism beneficiaries look generationally attractive. Foreign visitors had lagged pre-pandemic levels but hit 8.5 million in 1Q24, a 7% increase on 2019, and spent a record 1.75 trillion yen (11.3 billion U.S. dollars)

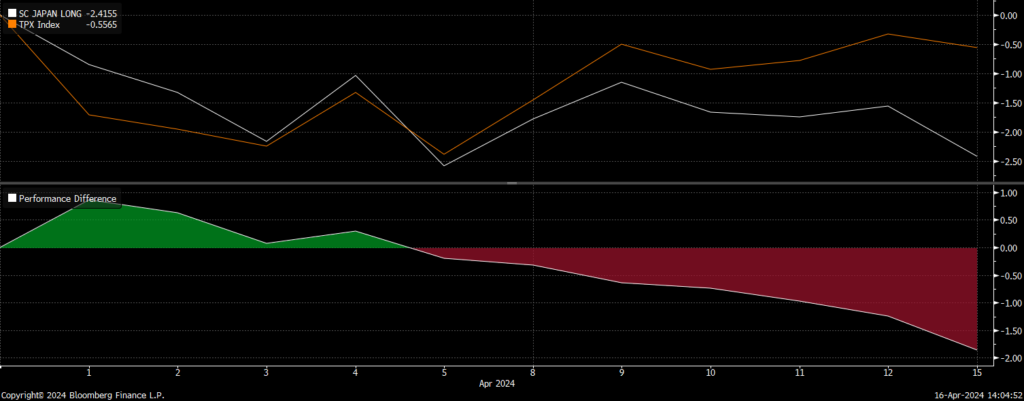

Chart 1: relative performance of the SC Japan quantamental portfolio versus the Nikkei IN 2024

April 2024 – Japan SC quantamental portfolio has underperformed by -1.9% in April 2024, and by a massive -8% in 2024 versus the Topix.

Since 2018, our Japanese basket has underperformed by more than 20%: comming essentially from the last 2 years.

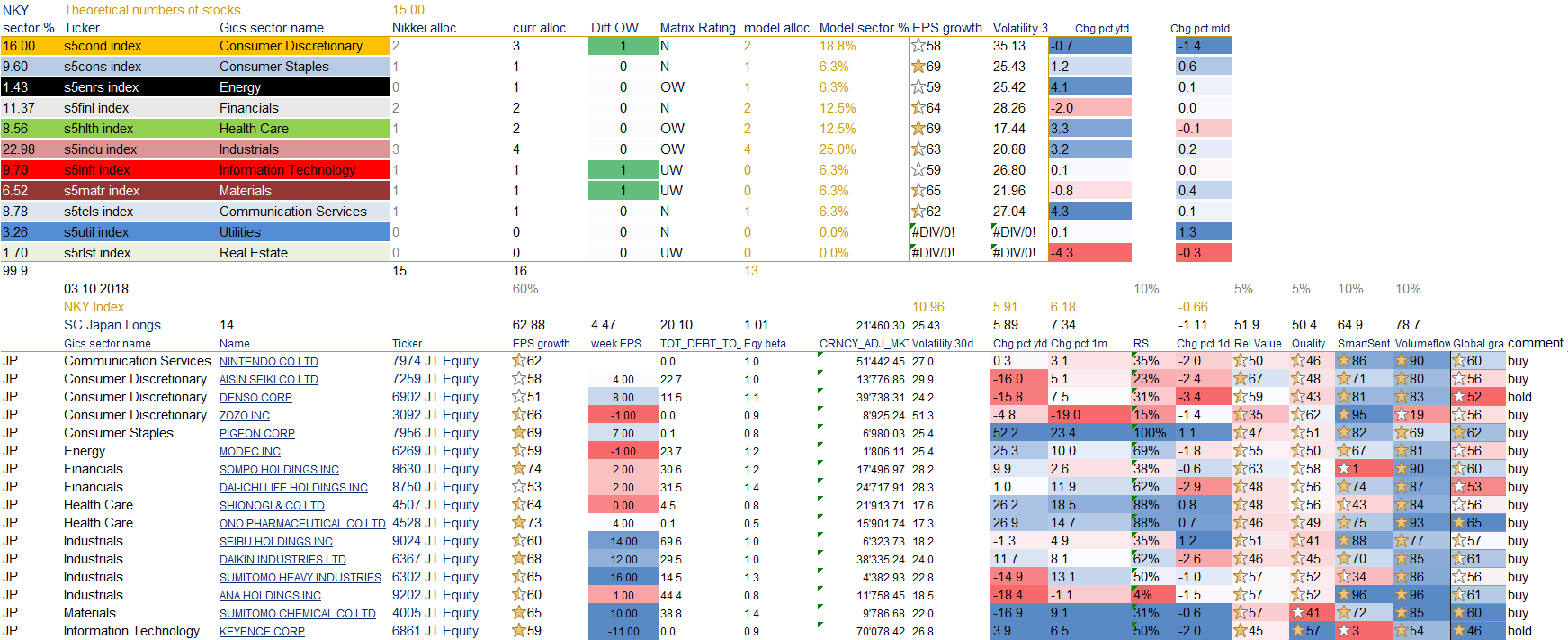

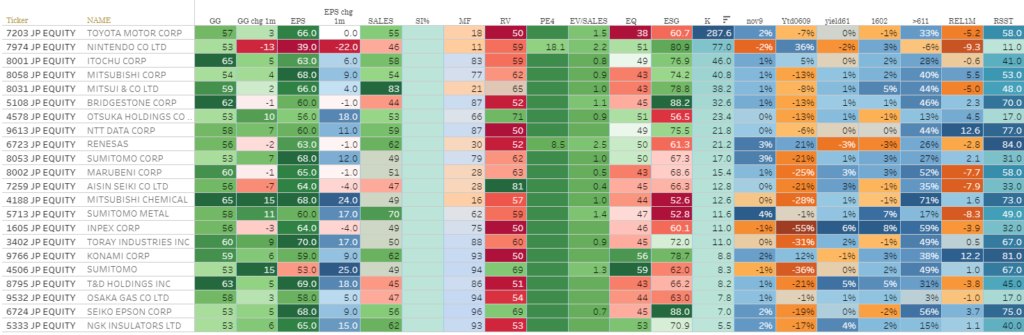

September 2021 – Japan has been upgraded to OW, thanks to political changes. We think it could be the best stock market performance for the next 18 months. Starting with the lowest valuations of all regions, with a vaccination catch up, the election of the Lower House, US tapering favouring higher USD/JPY and higher NIkkei, a makor fiscal stimulus. A screen of the best mix of value and Growth grade show the following stocks. We add for reopening theme 4967 jt.

Portfolio rebalancing

June 19th: we close 6758 JP

May 2nd: we close 6762 JP

May 1st: we close 6857 JP

April 22th: we add 6098 JP

April 18th: we close 9021 JP

April 17th: we close 9503 JP, 4911 JP, 6479 JP, 4849 JP

August 30th: we add 6752 jt panasonic (EV driver), 9984 jt softbank, we close 1812 jt, 1925 jt, 8802 jt

March 29th: we close Nexon 3659 JT, 8411 jt Mizuho Fin. We add 2413 Jt, 7974 jt.

January 21st We add en-japan 4849 JT, chugai pharmaceuticals 4519, Mizuho Fin. 8402, Daiwa House 1925, Seven & I 3382, Shiseido 4911, sumitomo realty & dev 8830 and close Tasei 1801, Persol 2181.

2021

Since Oct 2018, the SC Japan quantamental portfolio has outperformed by 3% the Topix, but that outperformance has been +12% since December 2019.

december 2nd: We close 9433 jt (kddI),

October 30th: We close 3092 jt (zozo)

September 30th: We close 1802 jt

September 21st: We add 1925 jt,

September 03rd: We close 9602 JT, 1803 JT, 2267 JT, 3391 JT, 8113 jt. We add 1812 JT, 2127 JT, 6758 JT, add 3659 JT, 2181 JT, 8035 JT

June 12th: We close 1605, 3349 (stratospheric rise), 6098, 6367, dony 6758, 6762, 7276, 7832, 8802,

May 8th: We close 9437 jt

April 23rd: We close 5411 jp and add 1802

April 17th: We close 7974 jp

March 30th: We close 7956, 9024, 4507 & 2768

November 25th: We close 9984 JT as its grades have fallen in line with the Wework debacle.

Update May 24th: Our Japanese quantamental stock list is composed of the names with the best earnings momentum and with the best Money flows. Indeed, Money flows is an important factor for the performance of Japanese equities thanks to the investment from GPIF and other Japanese organisations in stocks that are part of the new Nikkei 400. In 2019 year to date, corporate Japan has already announced buybacks worth ¥4.8trn. The April to June quarter could be heading for the largest quantum of buybacks since the equivalent quarterly period in 2006. The table below assesses the likelihood of announcing a buyback in the near term.

Tactically, we like Japanese equities thanks to a structural lift in the profitability of corporate Japan, with MSCI Japan ROE pushing above 10% briefly in late-2018 and holding at 9.9%, compared with a 4% average during 1993-2012. MSCI Japan ROE could rise to 12% by 2025, closing the gap with MSCI World, as shown in the graph below:

Update of the Japanese quantamental list – We close Dai Ichi Life, Aisin Seiki, Sumitomo chemical, Sumitomo Heavy industries, Modec, Ana Holding (9202), Sompo (8630). We add stocks which are currently making the biggest buybacks in this quarter like Sony (6758 JT ), KDDI (9433) , Tokyo electron (8035), Mitsubishi estate (8802)