Most of the time, many of our recommendations are “convexity” position in order to be hedged and to profit from extreme market moves (both up and down).

Convexity can be described as the purchase of the following strangle:

- buy a low delta (out of the money) call

- buy a low delta (out of the money) put

Convexity positions have a high probability of finishing worthless at expiry (a 25% move in 4 months is a rare event), but with this trade, the fund builds protection against extreme moves.

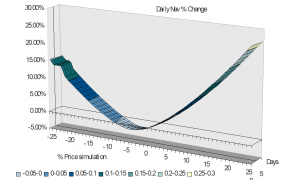

An example of the convexity profile of a theoretical portfolio

“Hohe Vol, für Stouff ist das toll”