Click here for list of charts…

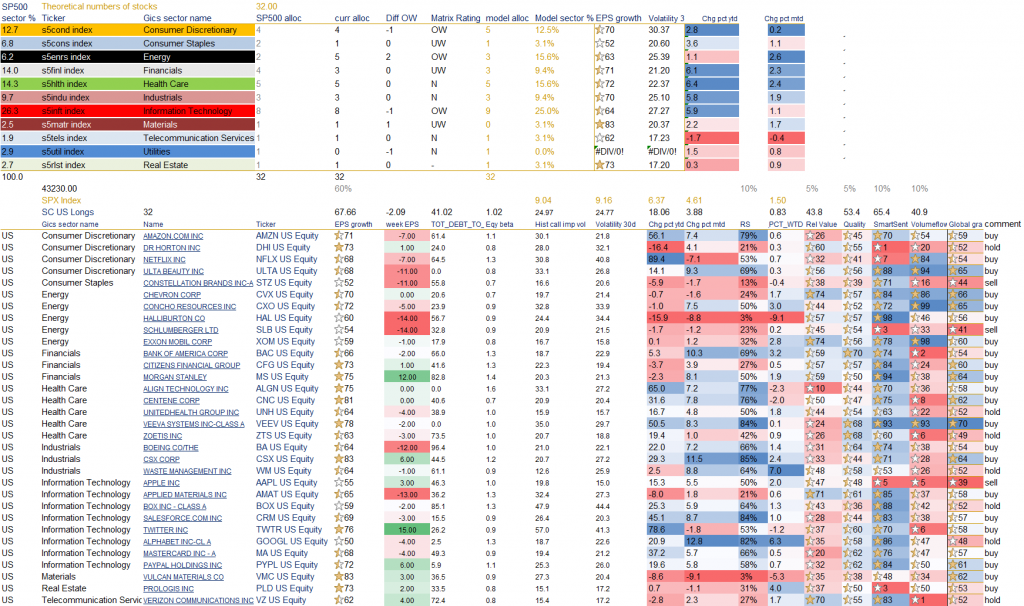

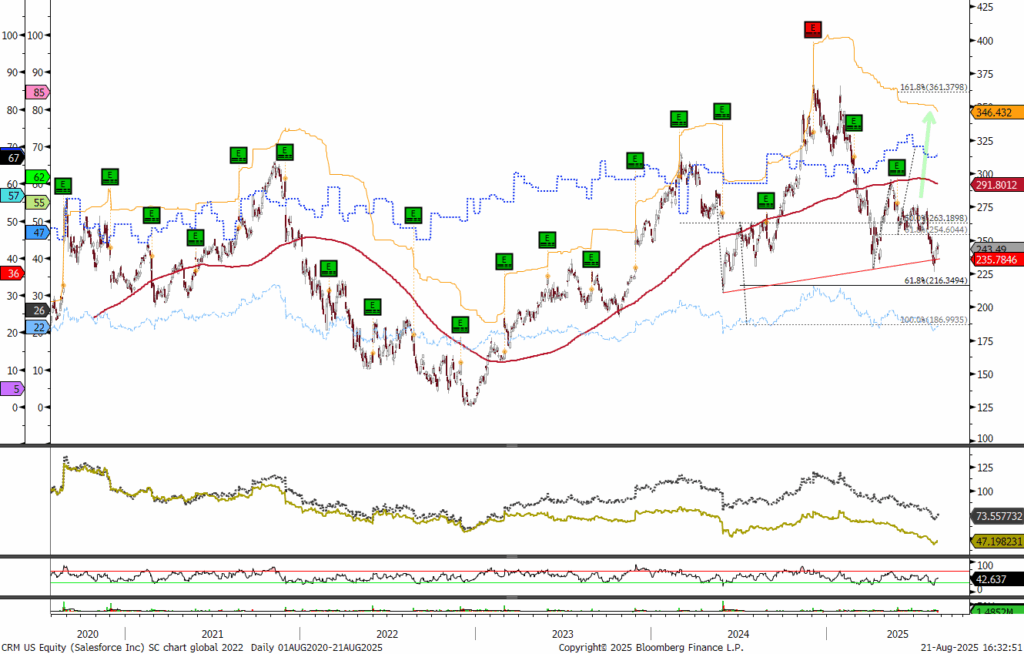

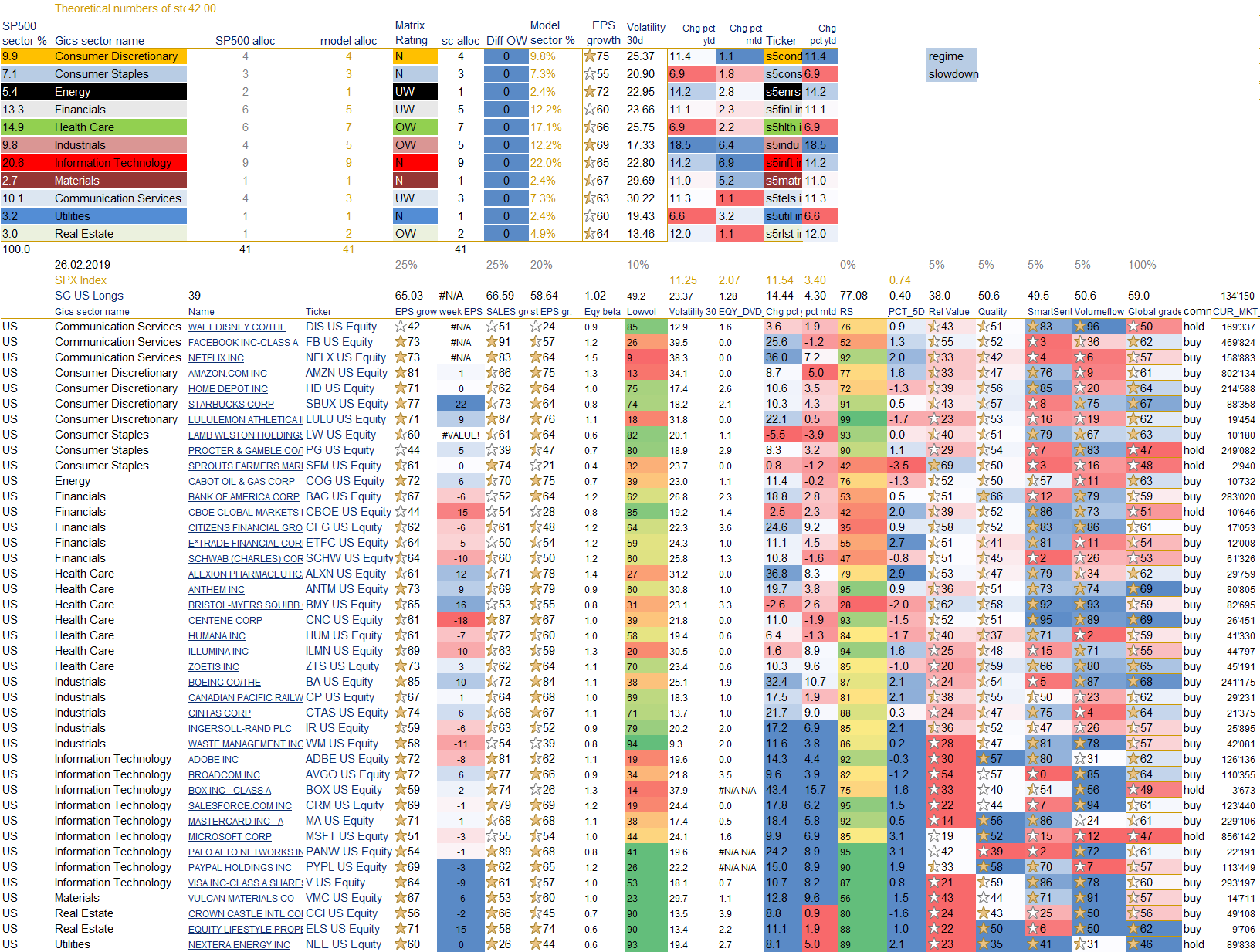

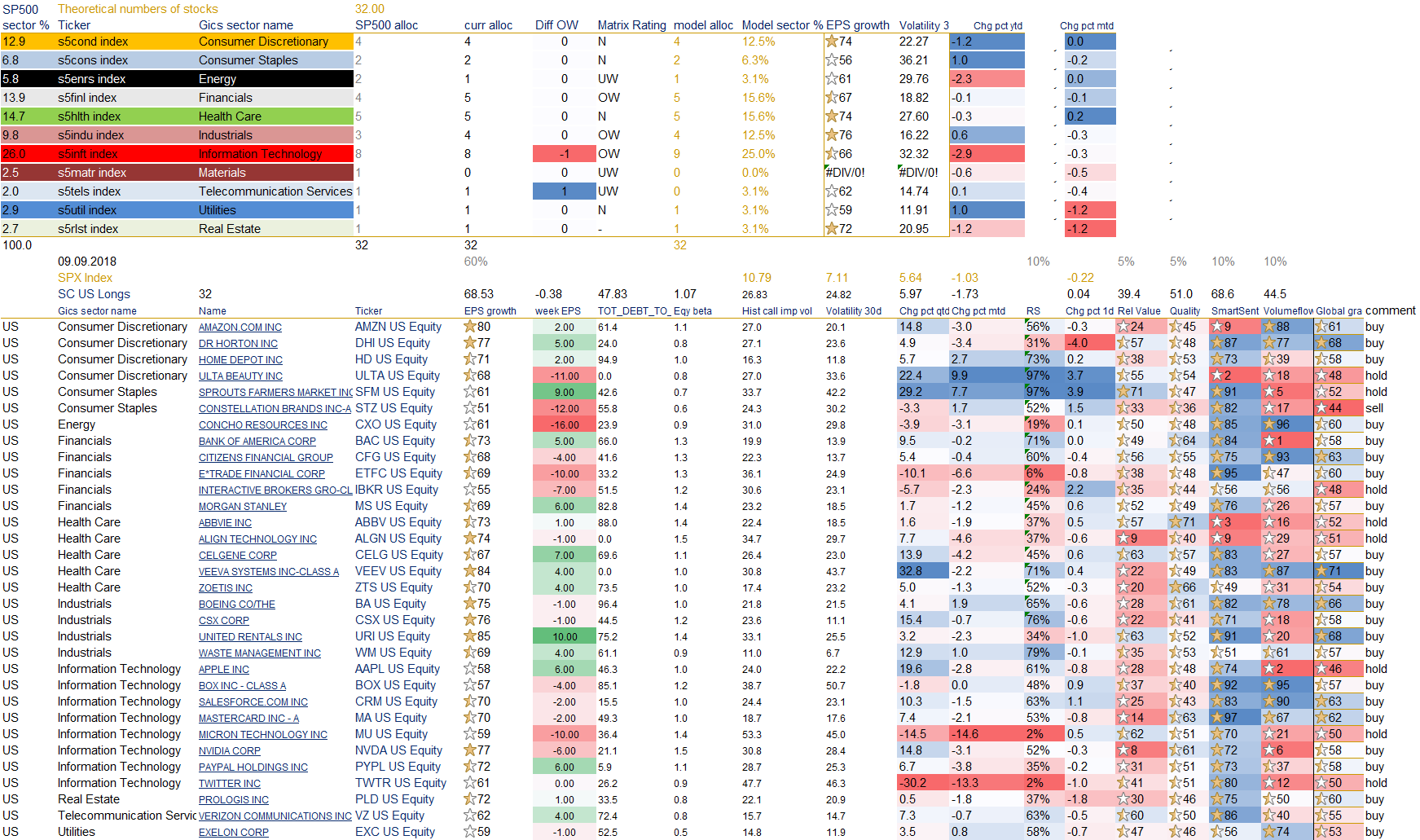

Charts of SCUS Longs as of August 21st:

January 8th 2026: we add AS US

December 22nd: we close HAL US

December 12th: we close AVGO US, we add UPS US, DECK US

December 9th: we add ARES US

December 8th: we close VEEV US, PG US

December 5th: we close NFLX US

December 1st: we close GM US

November 28th: we add TRGP US

November 26th: we close WDAY US, ROKU US, we add EQT US

November 20th: we close PANW US

November 18th: we close PLTR US, we add IBKR US

November 17th: we close CEG US, C US, we add BKR US, D US,

October 16th: we close HAL US, VTR US, we add PG US (low-vol)

October 15th: we add BSX US

October 9th: we add WFC US

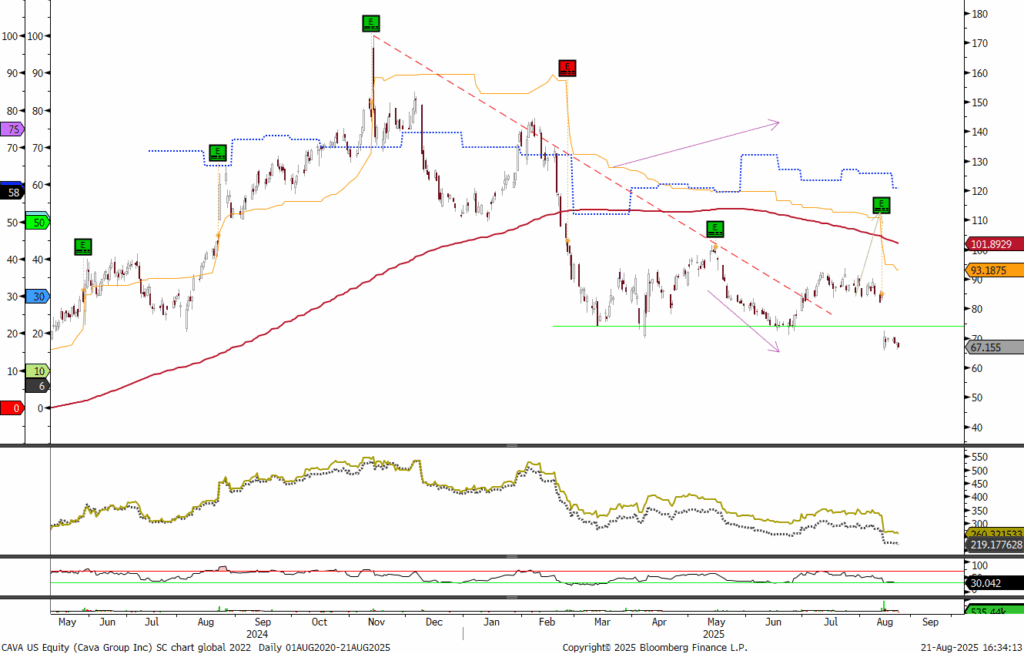

October 8th: we add CEG US

October 6th: we close COF US, D US

September 24th: we add FSLR US, TECK US

September 23rd: we close BA US, COST US, SYY US, we add APTV US, RCL US, HAL US, HBAN US, ROKU US, CHWY US

September 22nd: we add DELL US

September 19th: we add FSLR US

September 18th: we add C US, FCX US, APTV US

September 17th: we close BAC US, CAVA US, FI US, TOST US, we add EXPE US

September 12th: we add PWR US, SOFI US, WDAY US

September 4th: we add AMZN US

August 29th: we close DELL US, we add SNOW US

August 28th: we close MCD US

August 26th: we add ETN US, COF US

August 21st: we close CAVA US, we add GOOGL US

August 19th: we add MCD US

August 18th: we close PINS US

July 22th: we close PWR US before earning release (worst quarter) and EPS grade down to 46

July 22th: we close ELF US

July 18th: we close XOM US, we add AGI US

July 7th: we add GD US

June 23rd: we close BRK/B US

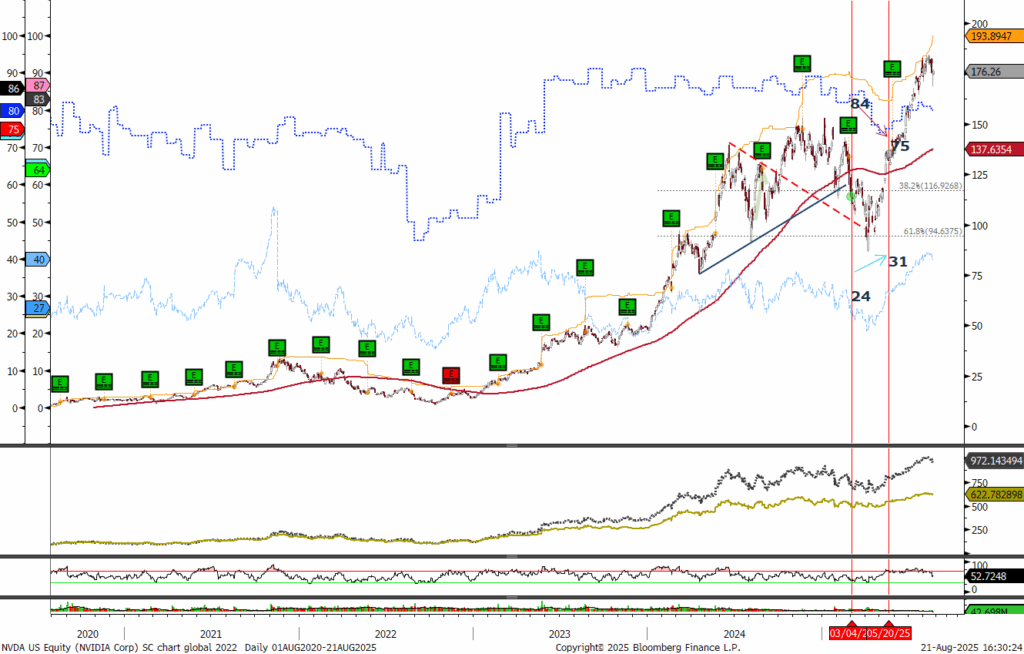

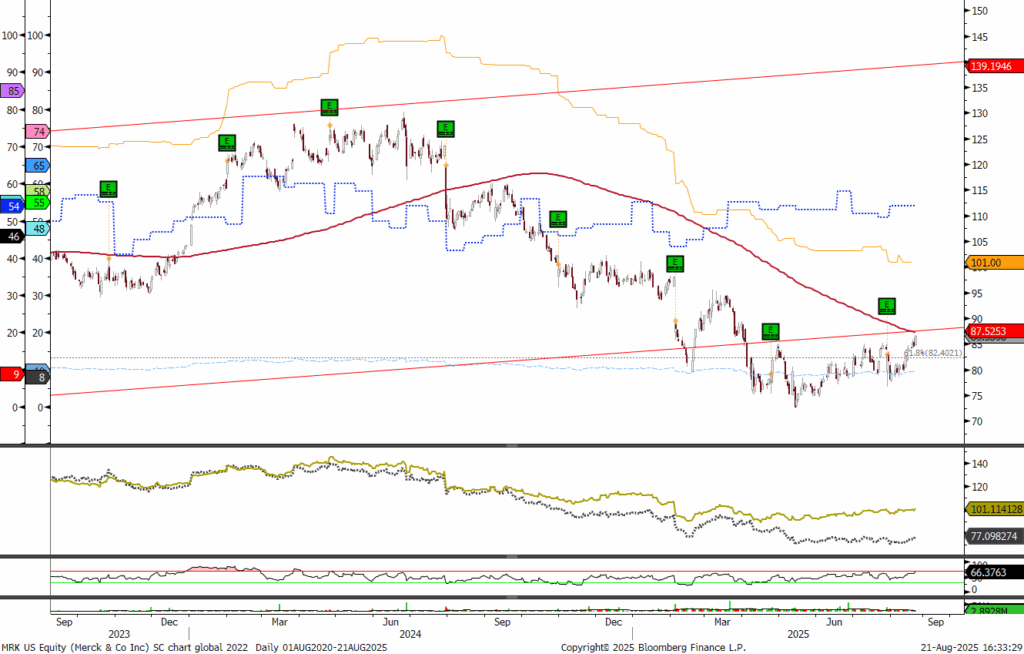

June 18th: we close HAL US, PG US, KR US, CNC US, SNOW US, NEE US, we add ARRY US, MRK US, SOFI US, GOOGLUS, SYY US, VRT US, JPM US, BAC US, APP US, NVDA US, PANW US, DELL US, ORCL US

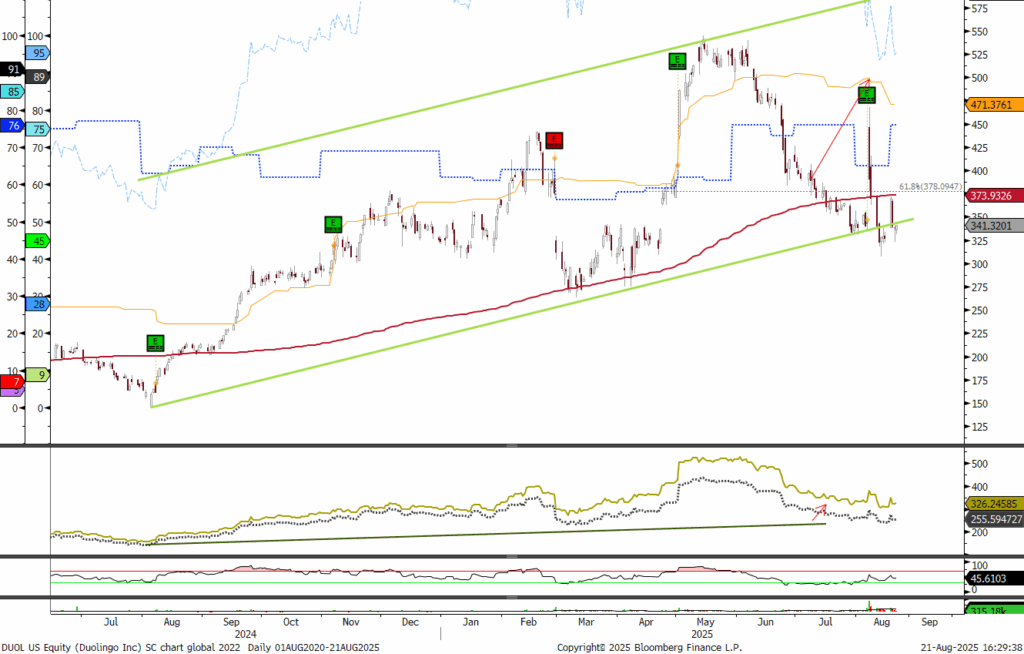

June 17th: we add AMD US, CAVA US, MAR US, DUOL US, LRN US

June 13th: we add ORCL US

June 11th: we close CHWY US, we add ELF US

June 10th: we add MAR US

June 9th: we add KR US

May 30th: we add COST US

May 29th: we close AAPL US

May 21st: we add PANW US

May 19th: we close AAPL US

May 16th: we add AVGO US

May 9th: we close GOOGL US

May 7th: we add ETN US

May 6th: we close CHDN US, NCLH US, FSLR US, we add SFM US, COST US, V US, MRX US, CLS US

April 28th: we close DELL US

April 21st: we add PLTR US

April 16th: we close GVA US

April 14th: we add CEG US

April 9th: we close AAL US, AA US, CRH US, JPM US

April 3rd: we add CNC US

March 25th: we add ETN US

March 24th: we add PLTR US

March 17th: we close INTU US, AA US

March 12th: we close PFE US

March 10th: we close TEAM US

March 5th: we close PSTG US, BSY US, HAS US

March 4th: we close GS US, we add NEE US, SYY US

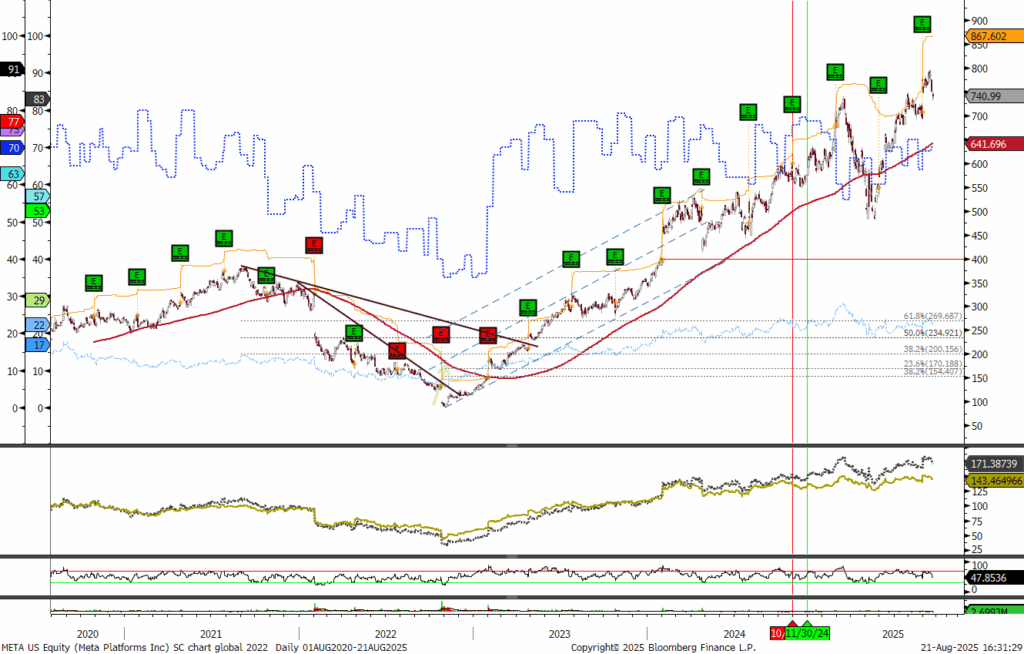

March 3rd: we add META US, TSN US

February 18th: we close AMZN US, DDOG US, we add DELL US

February 14th: we close BKR US

February 10th: we add DT US, AA US

February 7th: we close AMZN US

February 6th: we close NBIX US, we add PINS US

February 5th: we close DAY US, SNOW US, AA US, DELL US, ELF US, we add PWR US, GE US, AAL US, CHDN US, PG US, COIN US

February 3rd: we add TEAM US

January 27th: we close NVDA US, we add WDAY US

January 15th: we close TSLA US

January 10th: we add INTU US

January 8th: we close PFE US, SNOW US, MU US, PLTR US

December 17th: we close MCK US, we add PFE US, JNJ US (Shares of pharmacy benefit managers fell Monday after President-elect Donald Trump said he plans to “knock out” drug-industry middlemen, a sign the sector isn’t likely to see relief from political scrutiny during his administration.)

December 16th: we close IQV US, we add INTU US

December 4th: we close CHWY US, we add COIN US

November 27th: we close WDAY US, DELL US

November 25th: we close INTU US

November 20th: we add SNOW US

November 19th: we close TSN US, PANW US

November 13th: we close HCA US, PPC US, AVAV US

November 12th: we close FSLR US, we add TSN US, PG US

November 8th: we close FSLR US, we add FTNT US

November 7th: we close PCG US, PINS US, we add AA US, ELF US, CRM US, BAC US, GS US, NTRS US, AMZN US, GE US

November 6th: we close PG US, PWR US, we add CHDN US, LOPE US

November 1st: we close LLY US (after declining on 3Q earnings)

October 31st: we add TSLA US

Octoboer 30th: we close AAPL US

October 22nd: we close AMP US (we took profit before earnings as the stock is priced)

October 18th: we close NEE US

October 17th: we close UNH US

October 14th: we close IBKR US, LULU US, RGLD US, we add PINS US

October 2nd: we close AMT US

October 1st: we close WFC US

September 16th: we add MCK US

September 13th: we close ADBE US

September 12th: we add PWR US

September 10th: we close NSC US

September 6th: we add DAY US

September 4th: we close FCX US

August 28th: we add CHWY US, NSC US

August 27th: we close SMCI US, FCX US, we add BSY US, DDOG US, PFE US

August 20th: we close AA US, SLB US, we add LLY US, TSLA US

August 19th: we close AMD US, COIN US, we add NEE US, PANW US, CAT US, AVAV US, GVA US, PLD US, AMT US, PLTR US, MU US, META US, PFE US, IQV US

August 15th: we add LULU US

August 1st: we close INCY US

July 31st: we add AMD US

July 30th: we close GM US

July 29th: we close PFE US

July 25th: we close EW US

July 24th: we close V US

July 23rd: we close GM US, FCX US

July 19th: we close CRWD US (An update from cybersecurity-software company CrowdStrike on Friday appeared to cause outages for millions of users of Microsoft Windows devices worldwide, disrupting businesses ranging from airlines to the London Stock Exchange.)

July 18th: we close HAL US

July 11th: we add WDAY US, CRH US, HAS US

July 3rd: we close AMP US, JPM US, COIN US, PFE US, we add AXON US, PANW US, PLTR US, ONON US

June 24th: we add FCX US

June 20th:we add NBIX US

June 13th: we add ADBE US

June 12th: we close SHW US

June 10th: we close SCHW US

June 4th: we add ARM US

May 29th: we close D US, we add AAPL US, PLTR US, PINS US

May 22nd: we close AMT US, we add MRNA US

May 20th: we close PANW US

May 15th: we add NOW US, EW US, SMCI US

May 7th: we close PLTR US

May 3rd: we close ANET US

May 2nd: we add MRNA US

May 1st: we close MUSA US

April 29th: we close AAPL US, we add AMT US, CAT US

April 26th: we close MCK US, PFE US, we add SHW US

April 23rd: we close AMZN US, CI US

April 22nd: we close JPM US, FCX US, we add AMP US, IBKR US

April 19th: we add PANW US

April 10th: we add NKE US

April 9th: we add FCX US, AA US

April 4th: we close LW US

March 26th: we close CAT US

March 22nd: we add LULU US, LW US

March 21st: we close ZM US, we add PPC US, COIN US, BKR US, MU US, CSX US, QCOM US

March 20th: we close FANG US

March 15th: we close ADBE US

March 5th: we close WDAY US, we add AAPL US, PLTR US

February 29th: we close ARRY US, AMD US, CMG US, we add PSTG US, NCLH US, HCA US

February 21st: we close PANW US, NOV US, SHOP US

February 15th: we add WFC US

February 14th: we add RJF US

February 13th: we add V US

February 12th: we close MRNA US

January 22nd: we add ANET US

January 19th: we close MRO US

January 16th: we add PANW US

January 9th: we add ARRY US, AMD US

December 22nd: we close MRO US, NKE US (Nike slumped 12% postmarket after forecasting slightly lower sales in its third quarter on faltering demand in China and EMEA. It’s looking for up to $2 billion in cost savings by dismissing workers and streamlining products.)

December 21st: we add CPRX US

December 20th: we close BAC US

December 19th: we close LW US, FDX US, we add INCY US, MRNA US, PFE US, CI US ( Our US sector Matrix has upgraded Health-Care to Neutral and near the OW podium)

December 13th: we close DECK US, we add PINS US

December 11th: we add CI US ($10 billion buyback after calling off humana talks)

November 16th: we add QCOM US & RGLD US

November 7th: we close SPLK US

November 3rd: we close FTNT US

October 31st: we close EW US, we add BAC US

October 19th: we close ZTS US, SHAK US, GPK US, NEE US, we add PEP US, FDX US, CAT US, CHTR US, CMG US

October 6th: we add PXD US

October 3rd: we add UNH US

September 29th: we close TSLA US, we add NKE US

September 27th: we add FANG US, MRO US

September 21: we add Splk US: Cisco Systems (CSCO) will buy the data analytics and cybersecurity firm for $157 a share in cash, a 31% premium to the Splunk (SPLK) share price on Sept. 20. Cisco will pay a $1.5 billion termination fee if the transaction does not close by March 2025; there is a 9% return on the deal.

September 19th: we close IR US, we add IBKR US

September 18th: we close W US, NFE US

September 13th: we add ALB US, ABNB US

September 11th: we add NEE US

September 8th: we add HUM US, . we close DAR US

August 21th: we add SLB US, NOV US, NFE US. we add a staples LW US, and a bank like JPM

August 4th: we close PLTR US

August 1st: we close MRK US, MCHP US, NFE US, JNPR US, EW US, LW US, MA US, V US

July 5th: we close PFGC US

July 3rd: we close JPM US

June 30th: we close ABNB US

June 22nd: we add DAR US

June 21st: we close PAYC US, we add SHAK US, PG US, JPM US, MA US, V US, MRK US, PFGC US

June 14th: we close ELV US

June 13th: we close MRK US

June 12th: we add WDAY US

June 8th: we close SLB US, ALB US, we add MRK US, ELV US, MOH US, EW US

June 5th: we close AMD US

May 26th: we add AMD US

May 24th: we close RGLD US, PWR US, CLH US, SNOW US, we add AVGO US, PLTR US

May 23rd: we close PFE US

May 19th: we close DIS US, NBIX US

May 16th: we close CPRX US

May 15th: we add INTU US

May 10th: we add PLTR US

May 9th: we close PFGC US, we add VRSK US

May 5th: we add AAPL US

May 3rd: we close CLH US

May 2nd: we close ANET US

April 21st: we close CB US

April 13th: we add RGLD US

April 12th: we close MS US

April 11th: we close WFC US, ARRY US, CAT US, EW US, MCD US, we add NFE US

April 3rd: we close UBER US

March 31st: we add PAYC US

March 29th: we close WBS US, we add DECK US, CMG US

March 22nd: we close KEYS US, HASI US, we add MCHP US, FTNT US, MSFT US, FLEX US, CPRX US

March 17th: we close META US

March 9th: we add UBER US

March 3rd: we add MCD US, JNPR US

March 2nd: we add GPK US, DIS US, MTCH US

March 1st: we close UNM US, COST US, ADM US, INCY US, we add GOOGL US, IR US, CAT US

February 28th: we close UNH US

February 27th: we close AAPL US, XOM US, MRK US, we add NVDA US, CRM US

February 16th: we close PFE US, AMD US, we add MS US

February 10th: we close TSLA US, we add FTNT US

February 8th: we add MOS US

February 7th: we add DIS US

February 3rd: we add AAPL US,

February 1st: we close TSLA US

January 30th: we close NOW US, we add ELV US

January 26th: we add TSLA US

January 25th: we close CRL US, we add GPK US

January 24th: we close AQUA US

January 10th: we add LW US

December 30th: we add PG US, MSFT US, META US

December 20th: we add PWR US

December 15th: we close META US, we add CRL US

December 7th: we close COST US, CRWD US

November 21st: we close XOM US

November 16th: we close LULU US, DIS US, NVDA US, SBNY US, CHTR US, MLM US, ALK US, we add HUM US, MUSA US, NBIX US, ENPH US, PFE US, CB US

November 15th: we close RNR US, CNC US, SEDG US, DIS US, we add SHOP US

November 10th: we add NVDA US

November 9th: we add META US, we close HUM US

November 3rd: we close FTNT US

November 2nd: we close MA US, TU US, APD US, V US, ALK US, CHTR US, we add INTU US, CAT US

October 27th: we close WST US, we add AMD US, ANET US, SLB US, JPM US

October 25th: we close MOH US

October 19th: we close RE US, TWTR US, COP US, we add UNH US, HUM US, INCY US, CNC US, EW US, EWBC US

October 13th: we add LUV US, ALK US

October 11th: we close UNH US

October 7th: we add SNOW US, TU US, TWTR US

October 5th: we close PAWN US, PXD US, EOG US, SBNY US, we add LOW US, HAL US, COP US, NEE US, LULU US, POOL US, MRK US, PFE US

September 21st: we close INCY US, we add ADM US

September 7th: we close NOW US, PFE US, ATUS US, we add KEYS US

September 1st: we close EL US, UAL US

August 31st: we add PYPL US

August 24th: we add PANW US

August 08th: we close KLAC, and add BRKB, ADBE US, ATUS US, DIS US (through convexity), SNOW US.

July 22th: we close SIVB US and add HASI

July 18th: we close CBRE US

June 10th: we close MSFT US, we add MOS US

June 7th: we close T US, AES US

May 20th: we close LOW US, we add SIVB US, SBNY US, RE US, ALB US

May 19th: we close NRG US

May 9th: we add PFE US

April 29th: we add NLFX US

April 26th: we add UAL US

April 22nd: we close HCA US

April 21th: we close SCHW US, MCK US

April 20th: we close NFLX US

March 7th: we add APD US

March 6th: we close WFC US, we add CMC US, ZTS US

March 30th: we add RH US

March 17th: we close OSTK US

March 16th: we close NUE US

March 15th: we close FNV US, we add AQUA US

March 14th: we close TSLA US, we add UNH US

March 11th: we add INCY US

March 10th: we close WMT US, KBH US, we add CRWD US, V US

March 2nd: MCK US

Feb 23rd: we close HD US, ALGN US we add OSTK US, LOW US

Feb 22nd: We close TRU US

Feb17th: we add FNV US

Feb 11th: we close ZBRA US, we add RNR US

Feb 10th: we add SNOW US

Feb 9th: we close CAT US, DOW US, PHM US, LRCX US, we add COST US, TSLA US, UPST US, SBNY US, EOG US

Feb 1st: We close ABT US,

Jan 28th: We add AAPL US,

Jan 25th: We add NKE US, NOW ahead of earnings

Jan 19th: We close GS US, KEY US, we add BAC US

Jan 12th: We close T US, INTU US, AMAT US add PXD US

Dec 31st: We close AEE US, BAC US, Coca-cola; WE ADD zbra us, KEY US.

Dec 20th: We add CBRE US, T US

Dec 9: close EXR US, VFC US, sedg us, close AAPL on 10th

Dec 2, 3: add KO, WMT, ABT (increase low vol), add INTU, el us

Dec 1st: add CRM US, close DOCU ahead of earnings & close GNRC, ADBE with long puts for both

Nov 26th: we close RF US, CWH US, add LRCX US, NTAP US

Nov 19th: we close UI US, TSN US, PENN US

Nov 9th: we close V US, PYPL US and add KBH US

Nov 5th: Close COST US, WMT US, we add ABNB US

Nov 1st: Close BKR US, EHC US, V US, SEDG US, close NYT US

October 28th: We add tsla, Close FB US

October 13th: We add CRWD US, COST US, WMT US, FXC US, SCHW US, Close AGCO US

October 12th: Close UBER US, T US, DIS US

September 30th: Close IBKR

September 20th: We add T US, Close DOW, AMZN & AAPL

September 02nd: We add T US, UBER US (convexity) .

August 23rd: We add DIS US as Communication OW, WST US, TSN US, GOOG US, CAT US, AMZN US, UPST US, UI US, DAR US, BAC US, RF US

August 02nd: We close LLY US, ctas us, IDXX US, veev us, zm us, Add PHM US, exr us, APH US, WST US

July 30th: We close AMZN, MU, FCX, PM and BIIB, we add EHC US & AGCO US

July 23rd: We stop SAM US, add HCA after earning

July 16th: We close HCA US & FTNT before earnings and add PINS US

July 8th: We add ALGN US,

June XXth: We close CSL US, FNF US, LB US. We add DE US,

June 24th: We add NYT US as Communication moves from UW to neutral; to the detriment of Energy with the removal of COP US & APA US. We add DOW & CAT for the Infrastructure spending.

June 22th: We add MU US, close MOS US, MRK US, TTD US

June 17th: We add PAYC US, DOCU US & ZM US as tech back to OW and close JPM US

June 1st: We add lly us & BIIB US (through the purchase of call), GNRC US in Industrials, and close MS US & ALLE US (Financials are downgraded to neutral), MNST US, UNH US.

May 18th: We add PENN, moh us, PM US, CSL US SAM US & SAM, and close NOW US and PTON US.

May 12th: We replace BAH by HCA (theme of home hospitalization: HCA’s acquisition of BKD Home Health , adoption of H@H could enable hospitals to shore up margins as care delivery costs are typically lower by at least 10% and we note that HCA’s early participation in the CMS program gives it a first mover advantage that could boost EBITDA by $100MM+). we close CDNS US.

May 3rd: We add BKR US and close/stop ZM US and TTD US.

April 22th: We close ALLE US, ALXN US, BRK/B US, SCI US, OSTK US. .we add SEDG US, QCOM US.

April 8th: We close COST US, we add UI US.

March 11th: We close PAA US, PGR US, NBHC US, INTC US, LDOS US. We add NFLX, TTWO US,

Feb 24th: We close TDS US, GOLD US. Ee add OSTK US (reached 61.8% fibo retracement – see chart)

Feb 08th: We close SIRI US, BMY US, ABBV US, HAIN US, ROP US, STZ US. We add WFC US, COP US, PAA US (high SI) and replace NOV by xom us.

Feb 02nd: We close NEE US, ANTM US, and add LB US.

Jan 29th: we replace CXO (purchased by COP), by NOV

Dec 29th: we add INTC US and close LMT US

Dec 22nd: we add FLT US

Dec 10th: We close ipg us, TSLA US, fisv us, aiv us, add Y US (11 dec)

Dec 08th: We close avgo before earnings release and add MOS US, apa us, cxo us.

November 30th: We close BIP, OMC

November 19th: We add FISV (theme “vaccine”) , OMC (added on Nov 17th) & AIV

November 13th: We are making changes to adapt the portfolio to the rotation from momentum/ quality/ growth to high beta / value, from Tech to financials, energy. We do it while respecting our quantitative grades but we focus on stocks whose earnings momentum has vanished in 2020 but where earnings are expevted to rebound strongly all the more than a vaccinne is coming. The switch are: Tsla replacing Netflix, low & cmg in consumer discretionary, alle us in industrials. We puit the following names on review for the next days: mnst ?, msft ? , nee ?, now ?, nvda ?, pgr us, rop us ?, sci us?, zm us ?, veev ?. core conviction ldos, jpm, ms, nbhc, stz us, tds us, tdy , tru, ttd, v us, based on the 09 nov fractal.

November 6th: Following the US election, we get rid of confinement stocks ( stocks which massively benefitted from the Covid19) and add badly graded companies which benefitted from the confinement. OUT: EA, FCN, BOX. IN: BRKB/A, GS US

November 3rd: We add LDOS US, lmt us (fading a Blue wave before election outcome), we take profit on biib after its 50pct rise.

October 14th: We add JPM US, we replace tmus by TDS US. We increase staples with cost us, HEALTH CARE WITH LLY, BIIB AND REGN US. We replace BK US by MS US. In tech we add Apple, MA & BAH. We add BIP U/S.

October 2nd: We close MKC US and VIRT,

September 24th: We add FCX US

September 22nd: We add TRU US, FNF US and INTU US. We close NEE US, CCI US and MLM US.

September 8th: We add at the open CWH US and HAIN US. we close regn us % LULU US

September 1st: close AAPL us. We add TTWO US, CTAS US, LOW US.

August 21st: close dri, BIP, dlr, viac us. We add TTWO US, CTAS US, LOW US.

July 31st: close brkb and SEDG (extended and gg falling), SPGI. We add Apple. We replace veco by amd.

July 27th: close twtr and add BIP

JULY 13th: we add STZ US. We close NKE us, KSU and DUK US. We add NBHC (small cap but buy demark 13), BK US to increase financials. We add CMG US and DRI US to increase consumer disc. from UW to Neutral. We add FB US and Viacom – the company’s “early-mover advantage” in direct to consumer video, and the “mass market awareness and appeal” of its content, position the company to drive growth in streaming and digital revenues that more than offsets pressures on its linear business.

June 17th: with increased materials, we add MLM. We close vz us and FB US, replaced by ZOOM (ZM US). Industrials up: we add TDY just on a wave 4 support and also ksu (see cahrt below):

June 15th: add AMAT, fcn

June 09th: we close DAR US, MDLZ US as staples are downgraded to neutral. We take profit on AJG US as financials are downgraded to UW. We close SO US as utilities down to neutral. We add FB US and VZ US. We add sci us for cons disc. In tech, we add VECO & DBX US. We replace TMUS by TWTR. In industrials, we add RSG.

June 03rd: We add NKE US

May 18th: Here is our weekly report, on which we base our updates: Julia comments are “SC US long: TSN grade went down, could close

Matrix: need to add Tech (for example, KEYS, NLOK, AVGO), close Utilities (could take profit on DUK), close Consumer staples (can close TSN, K)”

We close TSN US, K US, we add AVGO US, AJG US, NKE US, HD US, mkc us

Here is our weekly report, on which we base our updates: Julia comments are all grades are ok – Could take profit on TTD and TMUS – grades going down and they performed well. Also can take profit on FTNT – it performed very well and there is DM sell Matrix: need to reduce Utilities and Consumer Staples, add Industrials

May 1st: add tsn us

April 29th: Close bsx, xpo, we add k us

April 23rd: Close KKR, we add brk/b,

April 16th: Close bx

April 15th: Close FB, EL, MA, QSR, ROP, SBUX, UBER. We add

APRIL 14: CLOSE BAC, URI, MS

April 1st: we add two picks: Regeneron (REGN) , the company has the best hope for both an anti-viral and a vaccine against Covid-19, which replaces centene. Then, Digital Realty Trust’s (DLR) as a way to play continued data center growth. We close JPM.

March 30th: we close strong outperformers like DG. we stop tesla, MLM & CTAS. We increase staples with MDLZ, chd us… WE INCREASE UTILITIES WITH duk & SO. HC – Replace aapl by NOW, WE ADD EW US. In financials, we add BX US AND virt us

March 17th: we close alk & BKNG, we add COST, GOLD, BSX, NVDA & Googl

March 3rd: we add TSLA and close WAL

Feb 3rd: we add PINS & UBER (our best call for 2020 in US) and close BKR & CSCO

Jan 15th: we close NOW and add MMP

Feb 03rd: we close CACC, IR, CMCSA, KL.

Feb 03rd: we stop CACC. We close IR US,

Jan 13th: we stop FIVE US after a big miss (story repeats itself see below with ULTA).

Jan 06th: we close EA, HIG, ADP, INTU, cprt (take profit), AMT,

Dec 19th: we add Cisco and reduce the number of our US names from 68 to 45, to ameliorate our performance. We close Qcom, HPE, csx, INCY, THC, SAM, SYY, COST, NRG, EVRG, HST.

Dec 18th: we add MS US

Dec 03rd: we add EA US. We close FFIV US & Flex. we close AIG US and replace it by CACC. We close BKR US. WE add CPRT US. We add KL US , QCOM US.

Nov29th: we add AAPL US & close SNAP US.

Nov25th: we close ROKU US.

Nov12th: we close GOOGL US, AZO US.

Nov 11th: we add CSX

Nov 08th: we add TTD & ROKU

Nov 07th: we add BKNG

Nov 04th: we add XPO US & SIVB US. We add COST.

October 24th: we stop TWTR

October 09th: we close dal and CP

October 15th: we close MO US

October 03rd: We add QSR

September 26: We add Sam

September 24th: We add THC¨, NRG

September 17th: we add names with a mix of value and growth, on dip (looking for start of wave 3), like FFIV, which replaces PANW (whose growth grade is down to a bearish 28), like URI, ALK and DAL which replaces the low vol CTAS. We close kdp us and Box.We add wal us and closes cost us.

September 4th: we close ULTA after its big miss and we replace it by FIVE, STaples are OW, we add KDP, EL & MO US. ALXN is stopped (we keep it as a trade).. We add BOX, EVRG and replaced alxn by unh. We add cnq in Energy.

August 30th: we close POST,

August 20th: we close UI US, UBER US,

July 31st: we add GOOGL US

July 11th: we close CNQ replaced by BHGE (baker Hughes), schw, zion replaced by AIG &SPGI. We also close xpo and increase CS with CMCSA.

June 26: Tech: we close BMY, replaced by MRK, we add VEEV and .IDXX. We close KSU. We close GOOGL.We take profit on CBRE.We take profit on BOX. We add CMG & TJX.

June 19: Tech: we close AVGO, MA and add CDNS and UBNT. Materials is OW: we add ECL & MLM. We add SNAP and close EA. We reduce discretionary with the close of BKNG for a nice profit. Staples: we replace EL by POST. We replace COG by CNQ CN.

June 12: we close ECL US and add INCY US. We replace EA by CMCSA. We add ULTA US, which replaces CMG. We add FTNT in Technology to replace PANW.

May 21st: we take profit in KL US, we add CBRE US & AMT US. We close AMD as tech goes neutral. We replace CHTR by EA. We add COP on retracement (stopped on May 24th). We replace FAST by XPO

April 30th: we close real estate (CCI & ELS are out). we close 2 health-care (whose sector is underweight) such as Zoetis (a strong performer for us) and Humana before its earning release. Tech (OW) we close TEAM & CRM and replace it by INTU & NOW. As materials is a new overweight, we add Kirkland and Ecolab. Industrials is also overweight – we close WM and add KSU. Financials,we replace CFG by RJF we add JPM. We add CMG to discretionary as the sector is upgraded to neutral. We add Twitter to Communication services as the sector is upgraded to neutral.

April 2nd: we close JPM and replaced by ZION. We increase industrials with MIDD.

March 19th: we close ETFC, BA, DIS, PG , SFM, BOX, HD – we add HIG, AMD, GOOGL, MSCI, COST, TEAM, ADP, AZO

February 26 & 27: We replace MO by LW in the consumer staples. We close CSX and Twitter. We replace excelon by ELS. We replace CBOE by JPM.

February 13th: we close MCD & JPM (CDiscr. down + lower quant grades) – take profit in CBRE – we replace VZ by FB – we replace ABBV & CELG with ALXN & ANTM – we add sbux & BOX

January 23rd: we replace MS US by CBOE US. We remove BKNG US to reduce our Cons. Discr allocation and add PG to increase staples. We take profit on KL to reduce materials and add one health-care ZTS.

January 14th: we add BMY, as it has one of the best mix of quant grades, while corresponding to current favoured factors (high quality, value, Div yield of 3.4%, low debt, strong FCF)

January 10th: we close BOX and replace it by TWTR

January 04th; we add AMZN US to respect our increased weight in Consumer Discretionary, we add 2 industrials (which is the best increase in our sector matrix) IR US & CTAS US, we reduce our staples allocation by removing COST and KO, and remove OXY to respect the underweight energy allocattion and declining quant grades. We stop Berkshire as its quant grade is down and financial sector underweight.

December 07th: we replace LLY US by the Gold miner Kirkland (KL US). We increase the number of our holdings by adding Broadcom.

November 27th: We close PM US and VEEV US. Our algos have reduced the low vol weight and increase the EPS growth. We add EXC and JPM US.

November 19th:

——————————————————————————————————————–

End October:

October 28-30th, we remove Concho as energy has become under-weight. We add Microsoft to replace NVDA. In terms of style, we have, during the month of october, added low vol stocks either coming from our low vol high EPS list or from stocks achieveing good earnings surprise like MCD, PM and KO etc… We add one material, VMC as the sector is back to neutral.

Past re-balancings

October 28, we remove Concho as energy has become underweight. We add Microsoft to replace NVDA. In terms of style, we have all the month of october, added low vol stocks either coming from our low vol high EPS list or from stocks achieveing good earnings surprise like MCD, PM etc…

October 19th:

We remove Oneok, which outperforms by 5% mtd, but whose eps grade is down to 55 and replace it by Philip Morris, to increase our staples allocation. We remove URI after its steep loss and replace it by ILMN to increase our Health-care allocation. These moves are part of a defensive tilt of the SC US list which started a few weeks ago with the strong weight in health care, The most striking change is the reduction of the grade for Industrials for the first time in many months. We take profit in Twitter and add Nextera. We close Algn before its earnings release and replace it by LLY. We remoce COP and replace it by a high quality name MCD.

October 1st:

discretionary: We remove dhi, ulta and buy BKNG – Staples: COST replaces STZ – Energy: we add OXY & COP – Financials: we close IBKR – Health-care: we replace ZTS by CNC – We increase our overweight in Industrials by adding CP – Technology: we close BOX, MU and add V, ADBE & NOW – Communication Services: we add FB – we close EXC & PLD.

September 7:

We remove GOOGL US and add BOX US again (after its post earning’s sell-off) and add TWTR to respect the Technology recommended weight. We reduce Health-Care stocks ahead of mid-terms elections and owing to a degrading rank in our US sector matrix: we take profit in ESRX and Centene and add the Consumer Staples SFM and one Utilities (sector rising in our matrix) EXL

31st August, (August perf: 5.29% vs 3.25% for S&P500 tr)

28 August, we remove BOX US before earnings release

As of 09 August, we remove XOM, HAL, CVX, NFLX, AMAT, VMC & SLB. We add again ETFC 5% lower than in June, and also add IBKR, CELG, ESRX, ABBV, URI and NVDA. Our US sector matrix made a U-turn closing energy and increasing again our health-care exposure.

As of 22 June, Our US sector matrix recommands reducing consumer Discretionary & Financials to increase Energy, Health-care and telecommunications. We remove WYNN, ZION & ETFC and add SLB, VEEV & VZ.

This list is composed of our best US picks based on sector ranking and best earnings momentum (the Eps growth grade)