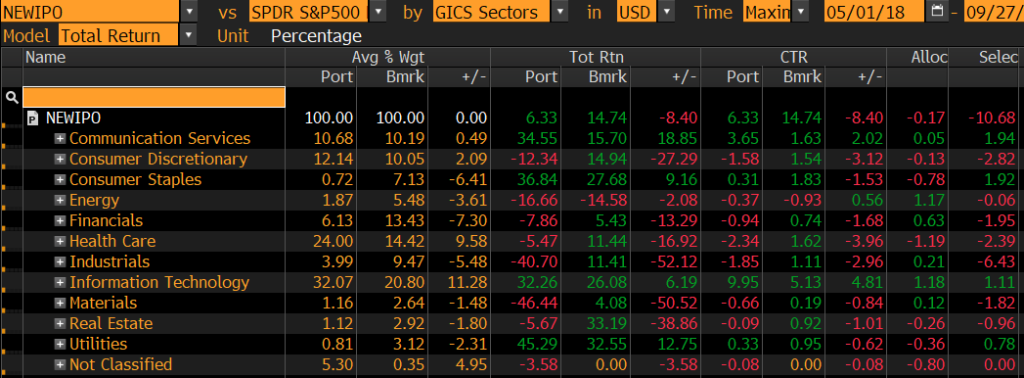

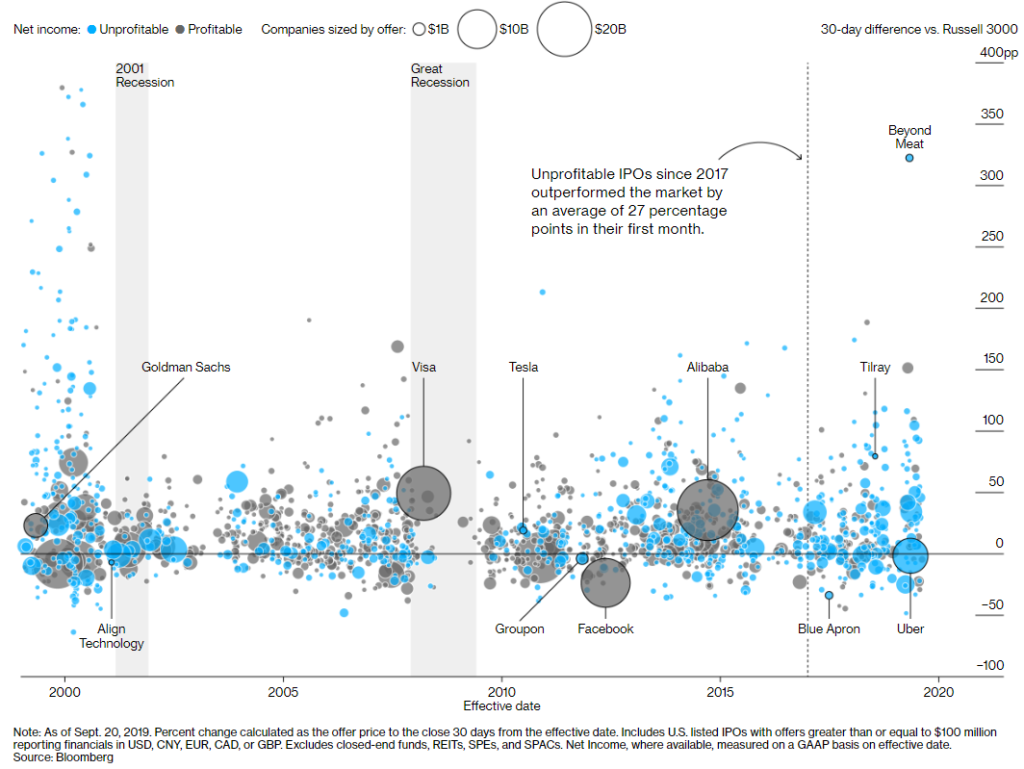

While we have been short IPO stocks during 2019 (see here), we recently closed that trade as these stocks have probably corrected too much compared to the S&P500. The chart below shows the 12 months performance of our SC list of US IPOS. The recent buzz on too many unicorns making their IPOs has unnerved investors. The rotation in sectors & factors from momentum to value since mid-August has specifically hurt softwares.

But the chart below shows that we are far from the 2000 buble:

Source: Bloomberg

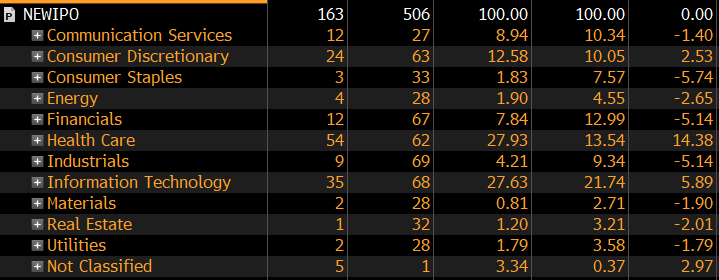

The allocation of the current list of IPOs is strongly overweight Technology & Health-care.