This is one of the worst DM countries’ performance for its equities. The relative performance is -16.5% versus the world since 2 years. We think it is too exaggerated and Spanish stocks have better quant grades than their European peers. Technically the Ibex is correcting above its 200 days moving average and a cluster of strong supports (fibo retracement, broken declining trend line). We expect a 10% relative return in the coming weeks.

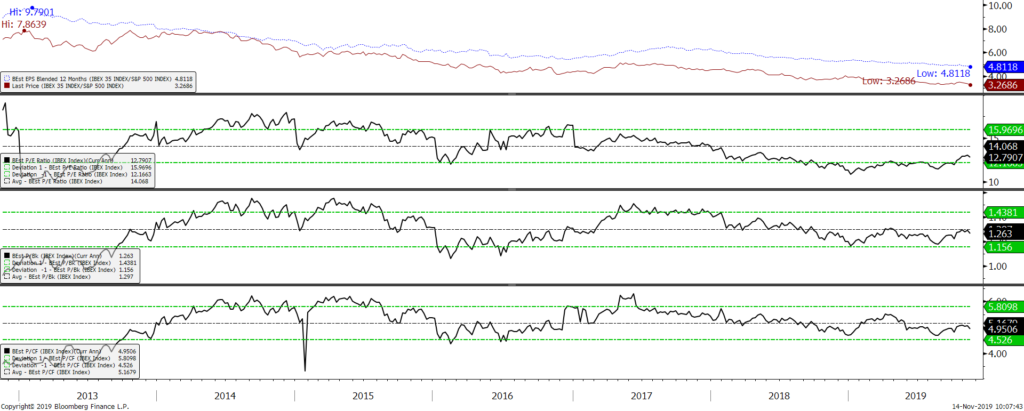

Relative valuation is also very attractive as shown in the below chart:

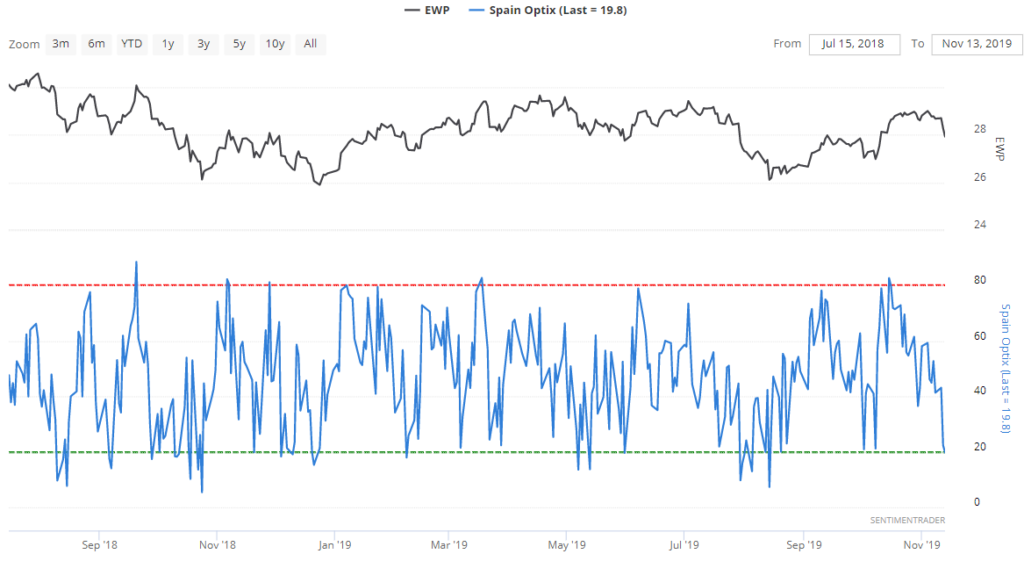

Finally, we have a bullish signal from contrarian sentiment indicator: