Fed Independance Vs Inflation

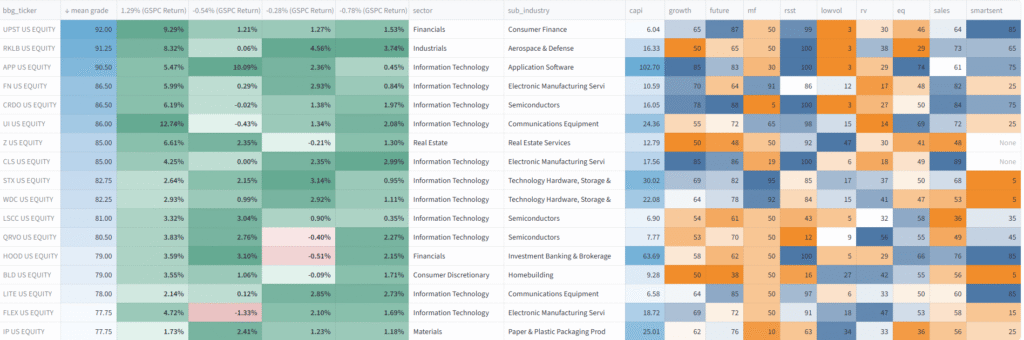

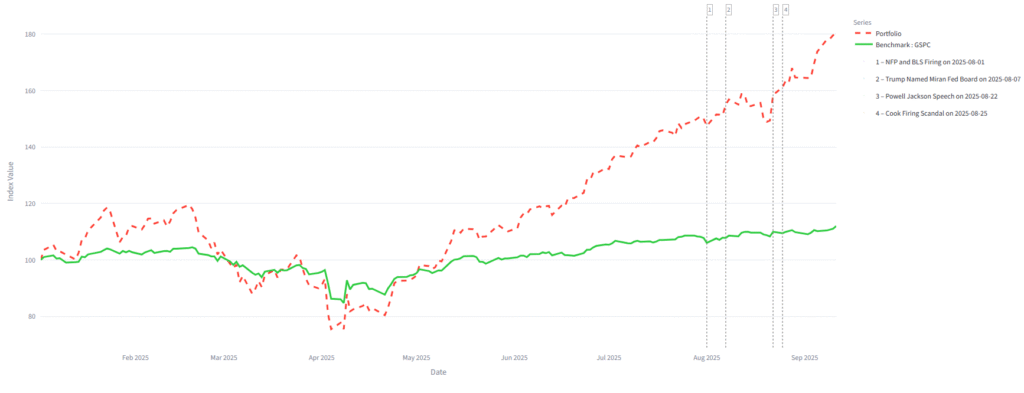

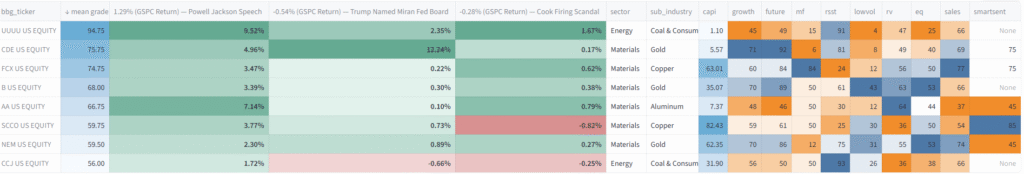

Outperformer Basket:

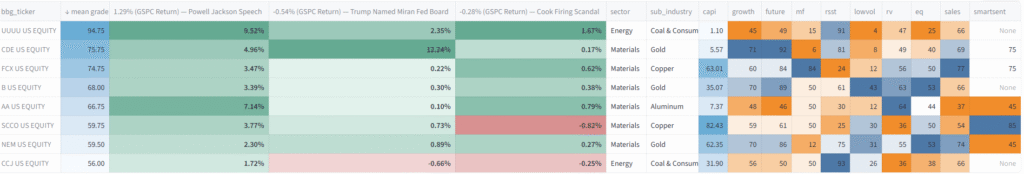

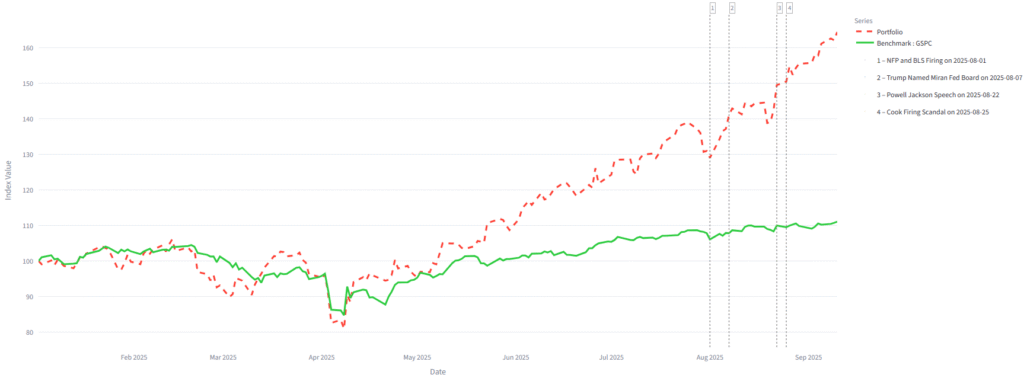

Miners Basket:

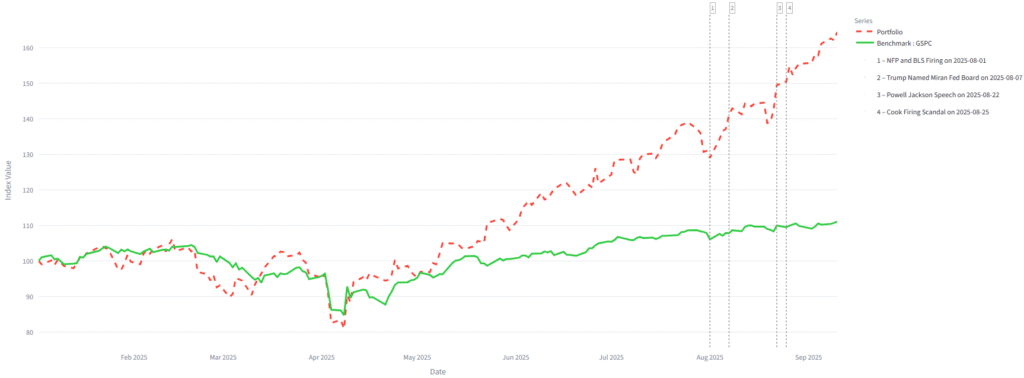

The Federal Reserve is the bedrock of the American economy, where the principles of integrity, transparency, and the rule of law are paramount. Confidence in the Fed’s role as the guardian of the U.S. financial system has been a market constant. However, the perceived erosion of its independence now poses a critical question for how this will be priced.

This analysis centers on two distinct yet interconnected market theses: the established “Inflation Trade“ and the emerging “Fed Independence Trade.“

The Fed Independence Trade is twofold. On one hand, it is a rate-cuts trade: discretionaries, financials and certain real estate industries (such as homebuilders) stand to benefit from lower rates, while growth stocks in technology would also gain as future cash flow are discounted at a lower rate.

On the other hand, it is a confidence trade—a bet on the integrity of U.S. institutions and the reliability of economic data. For example, if the head of the Bureau of Labor Statistics were replaced by a political appointee, markets might question whether reported figures understate the true weakness of the economy. This skepticism would be particularly critical because such data are critical to monitoring the impact of tariffs on U.S. growth.

In short, the Fed Independence Trade is not only about rate cuts but also about confidence in U.S. institutions. The core issue is whether the so-called “Fed Put” will continue to serve as a reliable backstop for financial assets—or whether its credibility, undermined by political risk, has become effectively “deep out of the money”.

The inflation trade is a well-known strategy. The goal is to target sectors such as real estate or commodities that have intrinsic value to counter the erosion of currency caused by inflation. Our positioning metrics provide evidence that markets have become more concerned about “Fed independence trade“, as there are signs of a “Fed inflation trade” appearing in rates, in equities through the value trade, and in gold futures.

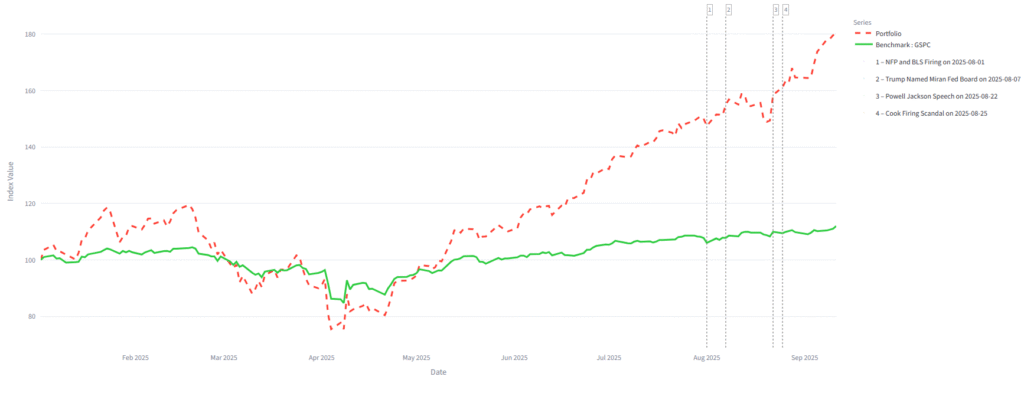

The Fed independence trade has been shaped by rising tensions between Powell and Trump since the start of the year. Pressure intensified in August, beginning with the August 7 announcement that Trump would nominate Miran to complete Governor Kugler’s term, followed by the August 22 report that President Trump would dismiss Fed Governor Cook unless she resigned. These developments have amplified concerns among economists and market participants about Fed independence.

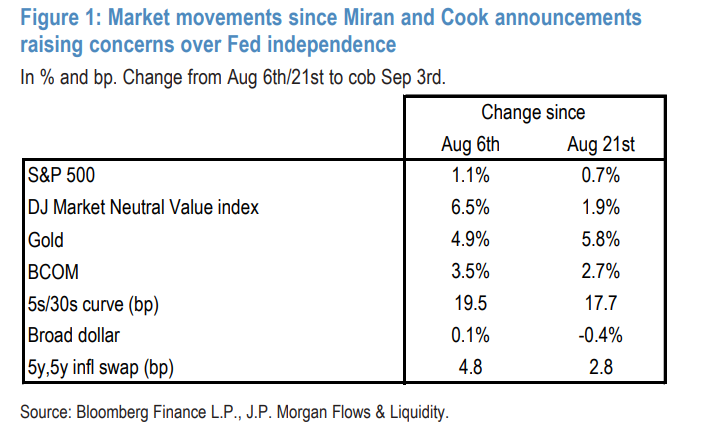

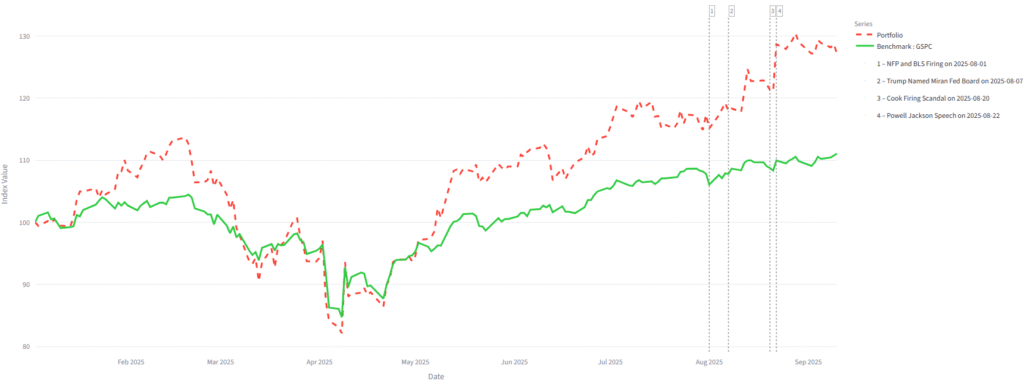

Starting with market reactions, Figure 1 illustrates asset moves since the day before the Miran announcement on August 7 and the subsequent threat on August 22 that President Trump would dismiss Governor Cook if she did not resign. Notably, August 22 also coincided with a dovish speech from Chair Powell at Jackson Hole.

Across these two periods of heightened concern over Fed independence, value equities and commodities—both of which tend to benefit from rising inflation expectations—rallied, while the 5s/30s curve steepened. By contrast, moves in the broad dollar and 5y5y inflation swaps were relatively muted. Indeed, the dollar strengthened during the equity and bond market sell-off on September 2.

The objective of this analysis is to assess the impact of each trade across key asset classes—first FX (with a focus on the U.S. dollar), then bonds, commodities, and finally risk assets such as equities. The aim is to identify areas of convergence between the two trades in order to construct a basket that captures exposure to both.

Dollard: Divergence

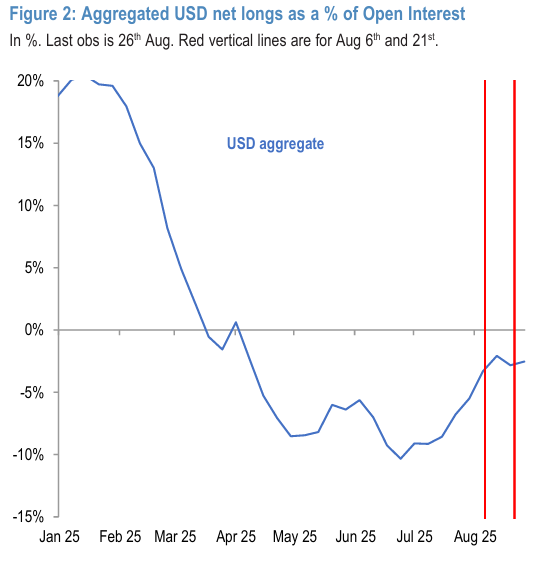

Turning to positioning, starting with the dollar, the implications differ between the “inflation trade” and the “Fed independence trade.” Under the inflation trade, U.S. inflation surprises would likely induce a hawkish Fed response and a rise in U.S. real rates, making long USD positions a natural expression of the trade. As money becomes more costly, demand from foreign investors—particularly those seeking to preserve value—tends to increase.

Figure 2, which shows aggregate USD net longs as a percentage of open interest, suggests that after dollar shorts were partly unwound in July and into August 5, momentum stalled following the Miran announcement on August 7. Since then, net short USD positions in currency futures have remained broadly unchanged. whereas the Fed independence trade points to steepening.

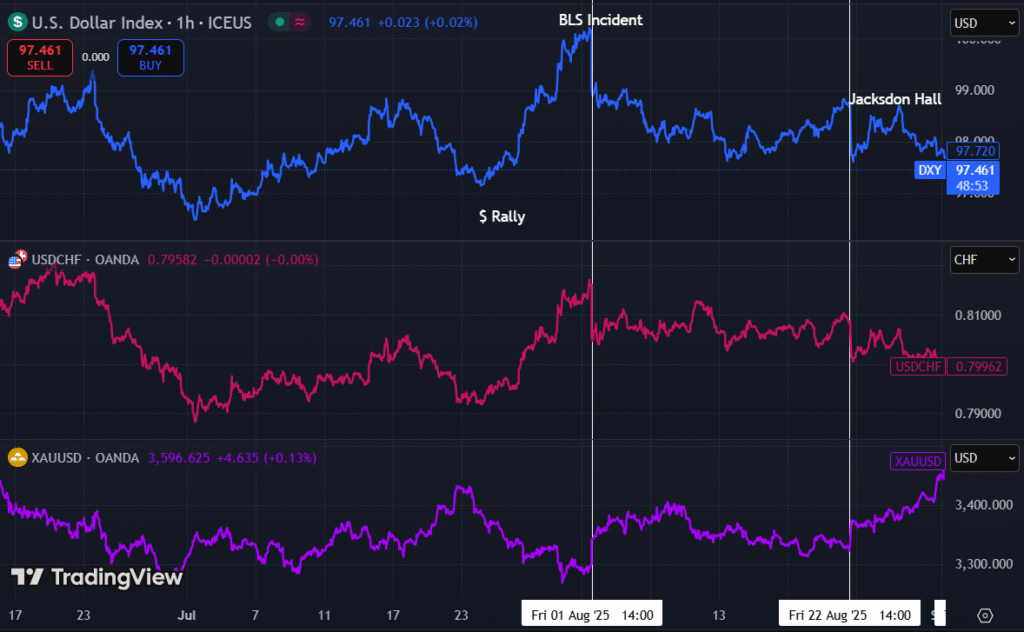

By contrast, under the Fed independence trade, a more dovish Fed stance would imply a decline US dollar demand, making short USD positions a logical expression. As you can see on the chart below each event associated with Fed independance the dollard index drop massively.

Bonds: Divergence

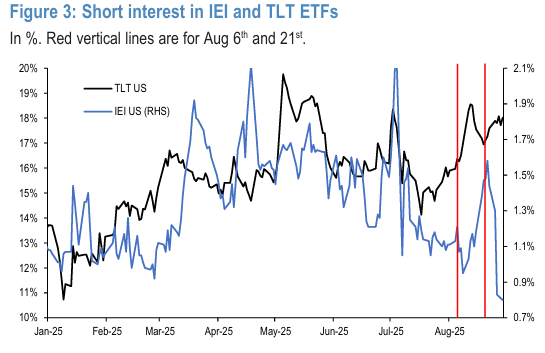

One way to gauge positioning is via short interest in major bond ETFs. Figure 3 shows IEI (3–7y USTs) and TLT (20y+ USTs). Since early August—and particularly after August 21—short interest in IEI has declined relative to TLT, indicating an increase in steepener positions, consistent with the Fed independence trade.

From mid-July, short interest in both increased, reflecting greater duration shorts. However, after August 19—coinciding with press reports that the FHFA Director was urging an investigation into Governor Cook (UST Markets Daily, Aug 20)—short interest in TIPs declined while short interest in TLT increased.

This pattern implies effective breakeven widening, consistent with market concerns about long-term inflation and Fed independence.

On the other hand for the “inflation trade” dynamic would also contribute to a flattening of the yield curve. The front end rises as policy rates are adjusted higher in response to inflation. At the long end, yields may decline or rise less than the front end for several reasons:

- Expectations of tighter policy reducing future inflation and growth prospects exert downward pressure on the long end.

- Pension funds and liability-driven investors typically increase demand for long-duration assets when rates rise, reinforcing downward pressure.

Together, these forces explain why inflation shocks often lead to curve flattening: the front end reflects immediate policy tightening, while the back end is anchored by weaker growth and inflation expectations.

Gold & Commodities: Convergence

Commodities—particularly energy—are traditionally a key component of the “inflation trade,” given their strong influence on headline inflation metrics.

For the “Fed independence trade,” the implications for commodities ex-gold are more indirect. However, since political pressure on the Fed to lower policy rates is intended to support growth or “run the economy hot,” stronger demand growth should also be supportive of commodity prices.

Gold, by contrast, represents a more direct manifestation of the “Fed independence trade,” since the core issue is confidence in U.S. institutions and their ability to manage the dollar in the interest of the economy rather than politics. In this context, gold serves as a safe heaven when confidence erodes. Added to that, central banks holds more gold than us treasuries fo the first time since 1996 (here). The chart below illustrates this relationship clearly: each time the dollar weakens, gold prices rise.

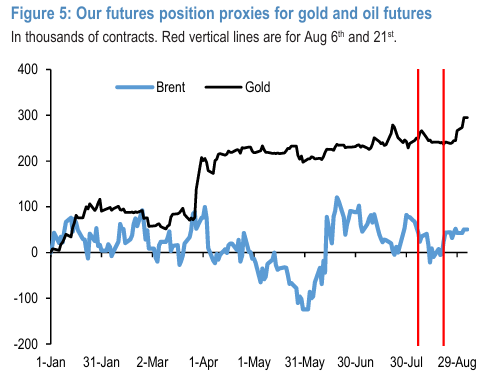

This figure shows futures positioning proxies for gold and Brent. It highlights a sharp increase in long gold futures positions following reports of Governor Lisa Cook’s potential removal.

Equity: Convergence

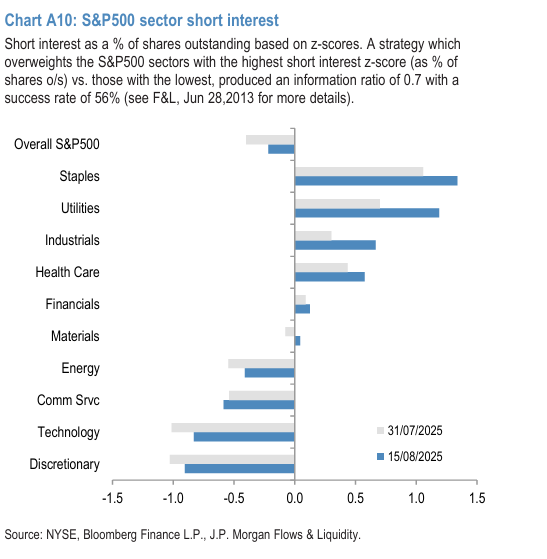

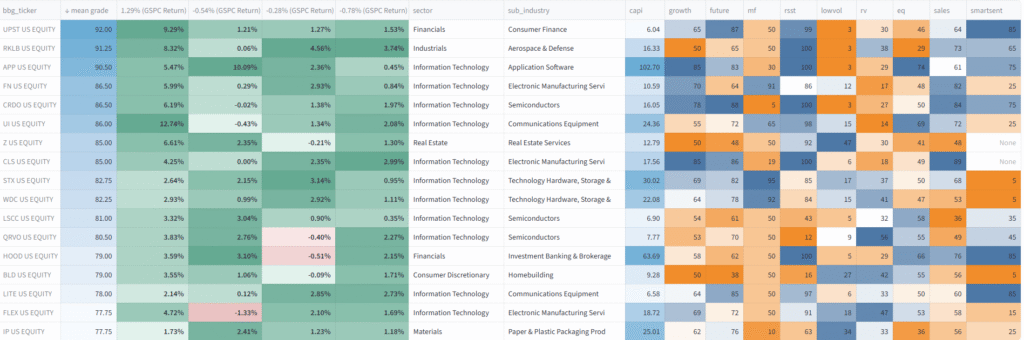

The value rotation was a key manifestation of the inflation trade in equities during 2021, and the implications of a “Fed independence trade” for equities should be broadly similar. The difference is that under the Fed independence trade, growth stocks may also benefit from rate cuts, particularly in areas such as technology and AI, which represent a broader structural shift. In addition, certain sectors such as discretionary could benefit from lower rates, meaning that both value-oriented discretionary stocks and growth-oriented tech stocks can perform well in this environment. as you can see with the sorted short interest graph below.

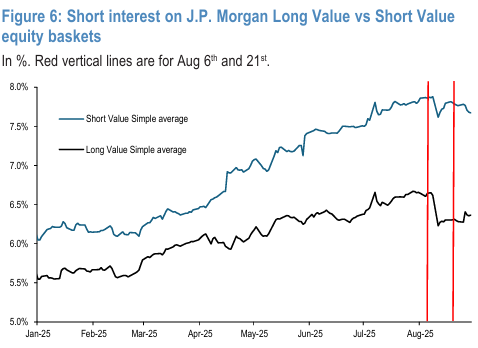

To assess the positioning around the value rotation trade, we compare the short interest on Long Value US equity baskets vs. the short interest on Short Value US equity baskets. In 2021, the short interest on stocks in the Short value basket had increased relative to short interest on stocks in the Long value basket, implying an investor shift towards value stocks.

Figure 6 (Short interest on J.P. Morgan Long Value vs. Short Value equity baskets) suggests that year-to-date, the gap between the two short-interest ratios has widened, with short interest on Short baskets rising relative to Long baskets starting as early as April. This gap experienced a sharp, discontinuous widening in the aftermath of the Miran announcement, consistent with the “Fed independence trade” manifesting through an investor shift toward value stocks.

Basket creation

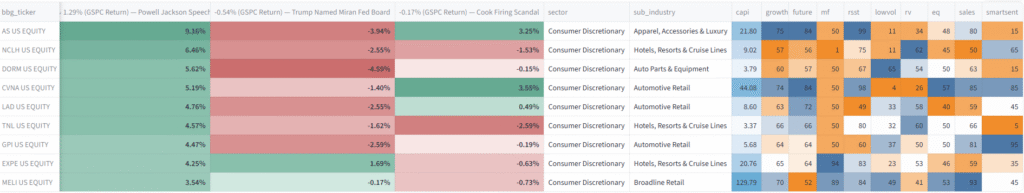

Our objectif is to target mainly value stock in sector that can benefit from both Inflation Trade and Fed Independance Trade, as suggested in the graph A10 we will first start with discretionnary. Added to that sentiment trader points out that : Whenever 17.5% of consumer discretionary stocks hit a 52-week high for the first time after a six-month low, and the S&P 500 was less than 5% below a five-year high, consumer cyclicals tended to move higher over the next year, posting gains in all but one case.

Outperformer

Financials

- UPST (Upstart Holdings) – Specialised in consumer lending; will benefit from rate cuts as access to credit becomes easier.

- HOOD (Robinhood Markets) – Retail brokerage platform; lower rates could increase cash inflows and trading activity, similar to the COVID boom.

Consumer Discretionary

- BLD (TopBuild Corp.) – Homebuilder and insulation installer; lower rates boost housing demand and construction activity.

Information Technology

- STX (Seagate Technology) – Produces hard drives; growth stock with a P/E of 28.50, demand supported by cheaper financing for data centers.

- FLEX (Flex Ltd.) – Provides supply chain, cloud, and communication hardware solutions; P/E of 25.49, benefits as AI and tech investments expand with lower borrowing costs.

- WDC (Western Digital) – Data storage company; P/E 18, not expensive, benefits from higher storage demand fueled by easier access to capital.

- LITE (Lumentum Holdings) – Optical and photonics products provider; benefits as telecom/AI firms invest more under lower rates.

- FN (Fabrinet) – Optical packaging and electronics manufacturing services provider; P/E 40, low debt, benefits from continued growth in demand supported by cheaper financing. Typical growth stock.

- CLS (Celestica) – Global supply chain and manufacturing solutions provider; benefits as lower rates encourage OEMs to expand production.

- APP (AppLovin) – Mobile app marketing and software company; benefits as lower financing costs fuel advertising and gaming demand.

- CRDO (Credo Technology) – Provides connectivity solutions for data infrastructure; strong earnings surprise of 43%, benefits from rising data/AI investment enabled by cheaper capital.

Real Estate

- Z (Zillow Group) – Operates real estate and rental marketplace; benefits as lower mortgage rates stimulate housing transactions.

Materials

- IP (International Paper) – Global producer of renewable fiber-based packaging and paper products; benefits as lower rates support industrial and consumer demand.

Consumer Discretionnary

We focus mainly on value stock for discretionnary with relatively low PE, maximum 20.

Auto Related

- CVNA +5.19% — Carvana is an e-commerce platform for buying and selling used cars entirely online. The stock is highly sensitive to financing conditions since affordability and used-car credit spreads drive volumes.

- LAD +4.76% — Lithia Motors is one of the largest U.S. auto retailers, selling new and used vehicles and providing financing and services. It trades at a low PE (~10), giving value investors leverage to any rebound in volumes if credit loosens.

- GPI +4.47% — Group 1 Automotive is another major dealership group with exposure to new and used cars, plus parts and service. A Fed rate cut would ease monthly payment pressure, so the equity (or selling puts near ATH) plays well on any softening of financing costs.

- DORM +5.62% — Dorman Products designs and distributes replacement auto parts for the aftermarket. After a strong run since August, selling puts can monetize elevated premiums while still benefiting from resilient demand for repairs.

Cruise / Restaurants / Leisure

- NCLH +6.46% — Norwegian Cruise Line runs a global cruise fleet targeting premium vacationers. The model is highly operating-leverage-driven, so softer financing costs and a soft landing could support discretionary travel demand.

- CCL +6.10% — Carnival Corporation is the largest cruise operator worldwide, offering mass-market itineraries across multiple brands. Lower rates can ease debt service and support leisure spending, but spending is discretionary and cyclical.

- TNL +4.57% — Travel + Leisure Co. operates as a timeshare and vacation ownership business, bundling resort access for private and corporate customers. Its model relies on financing for customers, so a cut helps affordability.

- EXPE +4.25% — Expedia Group is a global online travel agency with brands like Expedia, Hotels.com, and Vrbo. As an asset-light platform, it scales well with demand recovery and benefits more than traditional operators when travel volumes rise.

Consumption / Footwear

- MELI +3.54% — MercadoLibre is the dominant e-commerce and fintech platform in Latin America, with a strong payments ecosystem (MercadoPago) and marketplace flywheel. A more dovish policy environment boosts consumer credit availability across its markets.

- AS +9.16% — Amer Sports owns strong outdoor and athletic brands like Salomon, Arc’teryx, and Wilson. The portfolio targets premium, performance-driven consumers, and brand equity supports pricing power if discretionary spending stabilizes.

Miners, New Momentum

Our objective is to identify sectors that benefit from both trades.

On one hand, under the Fed Independence Trade, the ultimate goal is to achieve lower rates in order to reduce the debt burden while supporting growth. Basic industries — particularly machinery companies that require significant capital expenditures — stand to gain. Many of these firms carry substantial short-term debt; a lower Fed Funds rate would provide them with greater breathing room and the capacity to reinvest in new equipment. We therefore focus on companies with elevated near-term refinancing needs that would benefit most from easing rates.

At the same time, the Independence Trade carries risks. Rising political pressure on U.S. institutions — for example, under a Trump administration — could undermine confidence. This scenario typically supports higher gold prices. Combined with trade tariffs and the structural increase in demand for copper, this creates a strong case for miners.

On the other hand, miners and materials also stand to benefit from the Inflation Trade. In an inflationary environment, commodities retain intrinsic value, and mining companies are well-positioned to capture that upside.

Metals & Mining are supported by current commodity prices, strong seasonality, and robust momentum. Additionally, the sector tends to perform well during periods of bull steepening in the yield curve and in a weak dollar environment.

Gold

- Coeur Mining (CDE) +4.96%. As a gold and silver producer, it’s a classic inflation hedge. Lower rates boost precious metals by reducing real yields, making Coeur a leveraged beneficiary.

- Newmont (NEM) +2.30%. As the largest gold miner, it’s a textbook inflation hedge, and lower rates make gold more attractive, lifting its margins.

Copper

- Freeport-McMoRan (FCX) +3.47%. The copper giant is an industrial inflation hedge, as higher costs lift copper prices, and rate cuts spur construction and electrification demand.

- Southern Copper (SCCO) +3.77%. Copper reserves make SCCO a direct inflation hedge, while cuts improve liquidity and infrastructure demand.

Construction

- Barrick Mining Incorporation (B) +3.39%. With industrial exposure, it benefits from inflation through pricing power and from rate cuts through stronger credit-driven investment cycles.

- Alcoa (AA) +7.14%. Aluminum is tightly linked to energy and construction costs, making Alcoa an inflation play. Rate cuts stimulate demand in housing, autos, and infrastructure.

Uranium

- Cameco (CCJ) +1.72%. Uranium’s role in stable energy hedges inflation shocks, while easier financing under cuts supports long-duration nuclear buildouts.

- Energy Fuels (UUUU) +9.52% as uranium miners adn rare earths benefit from both energy security themes and speculative flows. Inflation helps via strong uranium prices, while rate cuts make financing easier for capital-heavy projects.