Fractals in 2024 and 2025

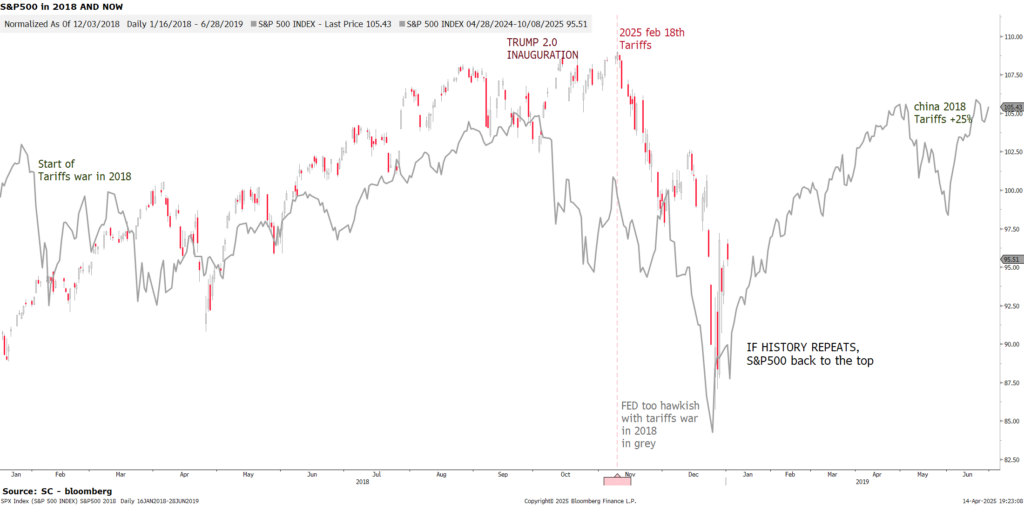

Fractal 1-b: Trump 2.0. {us} {ch} US/CHINA Detente NEW fractal – On May 12th, The US and China will temporarily lower tariffs on each other’s products in a dramatic ratcheting down of trade tensions that buys the world’s two largest economies three months to work toward a broader agreement. The combined 145% US levies on most Chinese imports will be reduced to 30% including the rate tied to fentanyl by May 14, while the 125% Chinese duties on US goods will drop to 10%. the parties will establish a mechanism to continue discussions about economic and trade relations. The agreement, which significantly lowers tariffs without any concessions, is likely to be viewed as a particular victory for China. The de-escalation comes after recent data showed a slump in trade across the Pacific Ocean. The two countries had earlier reported “substantial progress” in talks, which buoyed markets and helped Chinese stocks recoup their losses since President Donald Trump’s “Liberation Day” announcement of tariffs on April 2.

For this Trump 2.0 Fractal, we have many observations like the targeted Tariff on March 24th, the announcement on March 26 after the close of a 25% tariff on all imported cars, the 2nd April Liberation Day tariff announcement (Vietnam and Indonesia new tariffs and their impact on the global supply chain for Nike (half of shoes come from Vietnam), Adidas (39% from Vietnam), Abercrombie (35%) , Gap (27%), Pandora, H&M, 2313 hk (shenzhou intl) has its biggest drop in 18 years), 9th April is Trump’s capitulation (i.e., the 90-day reprieve) to limit the downside. Since Trump’s capitulation, we observe a de-escalation with more room for China to de-escalate, time for US tech and other multi-nationals like automobiles or Apple to take corrective actions ahead of tariffs impact. The chart below shows how correlated with 2018 are the two series in a similar context. On May 12th, we have a new fractal – US/China Detente fractal, with the postponement of Chinese tariffs.

So if history rhymes, let’s find which names should be the best performers in a continuation of a rebound. On the below chart, we created a list of strong Growth stocks which sold off massively during the Tariffs announcement (from Feb 18th to April 7th), but have made higher lows since then, with lower volumes and whose market cap is above 10bn$. Those are ideas for a continued rebound:

Fractal 1-b: Trump 2.0. {us} US TAX NEW fractal – On May 12th, the House Ways and Means Committee released its full text of the tax provisions to be included in Congress’ forthcoming reconciliation package. Among the key highlights: (1) Business: expensing 100% R&D, factories, caps goods, or 7% lower tax rate. See more here.

Fractal 2: DeepSeek – January 27th 2025. DeepSeek, a Chinese artificial intelligence (AI) startup, has developed two open-source large language models (LLMs) that can perform at levels comparable to models from Google, OpenAI, and Meta at a substantially lower cost. The news set off shockwaves in equity markets, wiping out nearly a trillion dollars in the market cap of listed US technology companies on January 27, with Nvidia losing nearly $600 billion of market value. Their magnitude of the resulting losses raises questions for investors about AI, now widely viewed as the next transformative technology. Software, which has received outsized focus as a key beneficiary of the “AI adopters” theme after the weekend’s news

Fractal 3: The clash of civilization waking up Europe or “Der Kaiser” – The meeting between President Donald Trump and Ukrainian President Volodymyr Zelenskyy on February 28 sent shockwaves across the world. Trump’s decision to temporarily halt U.S. aid to Ukraine, marked a dramatic shift in America’s role as the leader of the free world. This move, combined with his administration’s protectionist policies, signals a fundamental challenge to the postwar economic and political order the U.S. helped build. The echoes of history—ranging from the perils of economic isolationism to the dangers of appeasing dictators—loom large, as the global balance of power teeters on a fragile edge. Meanwhile, Germany, in response to the shifting security landscape, has abandoned its strict fiscal discipline, launching an aggressive stimulus plan that could redefine Europe’s economic trajectory. The package of more than €1trn reinforces our preference for German equities, highlighting a number of idiosyncratic Top Picks, e.g. Rheinmetal, RWE, Siemens, while getting convexity on U2 names like automobiles BMW, or basf. Recent fiscal developments in Europe are an additional tailwind to EUR where positioning remains short, raising the possibility of an outsized move higher.

Europe now finds itself in a desperate race to agree on plans for Ukraine’s security in the event of a peace deal with Trump already rushing into negotiations with Russia. Russia has prepared for this moment, assembling already its cast of top-tier negotiators. Europeans are worried that the US has made too many concessions already and is eager to declare the problem solved, leaving them with the fallout. Everything is moving fast and Europe is not good at moving fast. After next week’s German election, even though it may take weeks to form a new government, Europe will have to make a hard choice. This has some impact on European equities, that have benefitted from that new political clash of civilization: higher defense stocks, lower euro finally making Germam autos and chemicals rebound and lower natural gaz. Indeed, AdamsS expects more of a price impact in European natural gas markets, though. Request from Germany for gas storage exemptions on top of recent development for Russia/Ukraine have added immense selling pressure over the past week. It’s difficult to envision Russian gas flows resuming back to pre-conflict levels, but given that Dutch TTF prices have doubled over the past year it’s not difficult to imagine more selling pressure here.

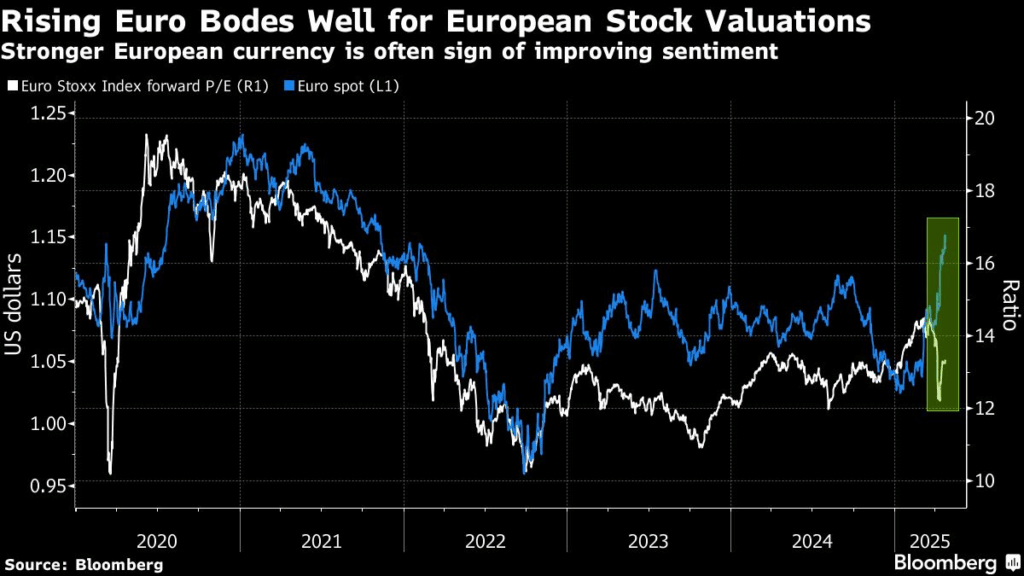

Our new Clash Of Civilizazion European Fractal – der Kaiser – unleashing budgetary stimulus, which parsimonious Germany can uniquely afford. The incoming government could: (1) reform the debt brake (With debt to GDP at 64%, Germany can easily invest 1% to 2% per annum on infrastructure, and thé constitutional “debt brake” affords “all sorts of wiggle room) – Potential tax reforms and regulatory changes could improve earnings for German companies, the performance of German Domestic companies has been negatively correlated with support in opinion polls for the FDP, which opposes fiscal expansion. – and (2) issue additional special funds with borrowing outside of the debt brake. This should lead to a pivot toward fiscal easing in 2025 (+20bp deficit) and boost growth (+15bp). We expect that the additional fiscal room will be largely directed toward business policies (e.g. lower energy prices, lower corporate taxes and duties). (3) higher Euro structurally: The Stoxx 600 has outperformed the S&P 500 by 11 percentage points this year, while the euro has climbed 10% against the dollar. Flows dynamics show the unwind of the US exceptionalism trade is under way, and the trend may still be in its early stages given how crowded US assets were at the end of last year. “If the repatriation were to continue, it could mean upward pressure on the euro and equity outperformance in Europe.

See more details on the Euro analysis, by clicking here…

Over the long run, stronger euro regimes were mostly associated with periods of EU equities’ outperformance. But, Further euro strength isn’t necessarily a good thing, however. Each 5% rally in the currency against the dollar shaves 1.5-2 percentage points off earnings growth in the MSCI Europe gauge. In fact, the earnings hit is manageable if the euro goes up for reasons including a better outlook for economic growth.

With a surging currency and higher US tariffs tempering appetite for European exporters, many are turning to domestically geared firms (see chart below). Against this backdrop, domestic stocks are back in favor after underperforming internationally-exposed peers for years. Focus on domestically driven businesses – We also saw scope for a sentiment-driven rally in the MDAX as the ECB continues to cut policy rates, and that proved the right strategy. Proposals to lower energy costs via the subsidisation of network fees within the electricity bill could help allay affordability concerns and support the German electricity grid build out for E.ON and Elia. Beyond this we see discussions around German nuclear restart.

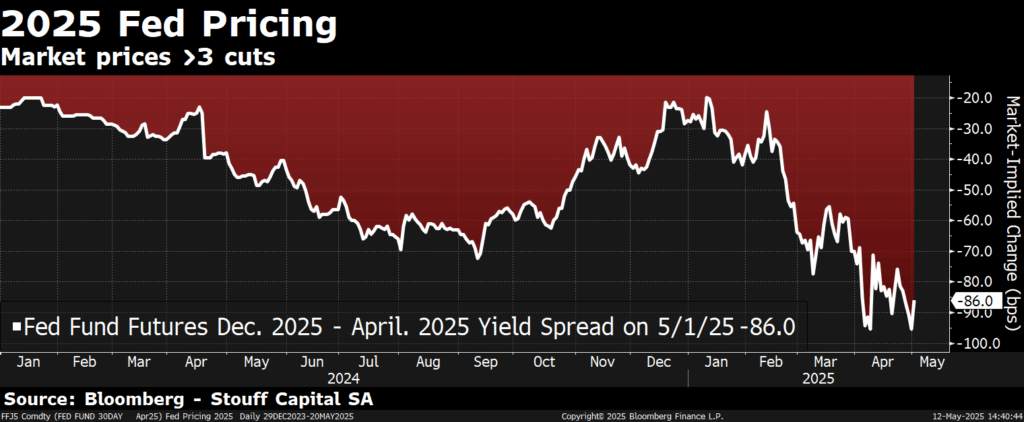

Fractal 4: The Art of Tragedy or the Fed – the Fed remains in a rate cut cycle, with now 3 rate cuts expected in 2025 (see chart below), as a function reaction to lower economic growth with new headwinds (tarrifs, DOGE, probability of recession rising to 40%). But, we observe a tale of two mandates, with Governor Waller leaning dovish, placing weight on employment, and Chair Powell, more cautious, warning of potential conflict between growth and inflation goals.

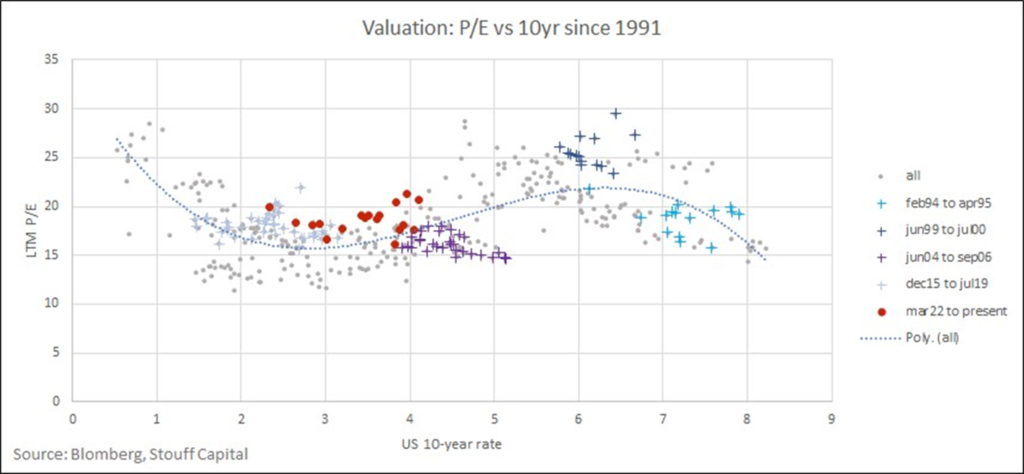

We allways check what rates and real rates do to get a better understanding on stocks behaviour. By the start of April, Bonds faced considerable pressure, with a disorderly liquidation of long term bonds. But recently, Though footing is still fragile, the fever has broken. Volatility in both rates and spreads has cooled materially.

Empirical data (see chart below) shows that stocks have encountered setbacks over the past two years when the 10-year Treasury yield exceeded 4.5% (e.g., October 2023, April 2024, see chart below) or during concerns over the dollar’s stability (e.g., the Yen carry trade unwinding in August). The below chart is our favorite to monitor the relationship between Real US long term yields and equities. Thus the current fall in real rates and 10YR from 4.8 to 4.4 should be positive. However, while US 10Y yields settle below 4.5%, lower rates are not benefitting equity returns to the same extent, with growth (both economic and earnings) now the prominent driver of equity indices.