Rate Cut 2025

Update November 17th:

In the last FOMC meeting, Powell adopted a more hawkish tone than expected, underlining the fact that the cut in December was not a certainty. He also highlighted the fragility of the labor market, especially that it is a problem of supply. He noted the Fed’s tools are mainly designed for demand, leaving their actions less responsive when faced with a supply shock.

We identified five segments of the economy that could theoretically benefit from rate cuts. The first was real estate, followed by small caps, consumer discretionary, financial sector, and finally growth stocks.

Of those four segments, only one has truly performed: growth stocks. This is because they are intrinsically linked to AI, the market’s new ‘love story.’ However, as Michael Burry has pointed out, this could be a dangerous narrative, potentially a bubble.

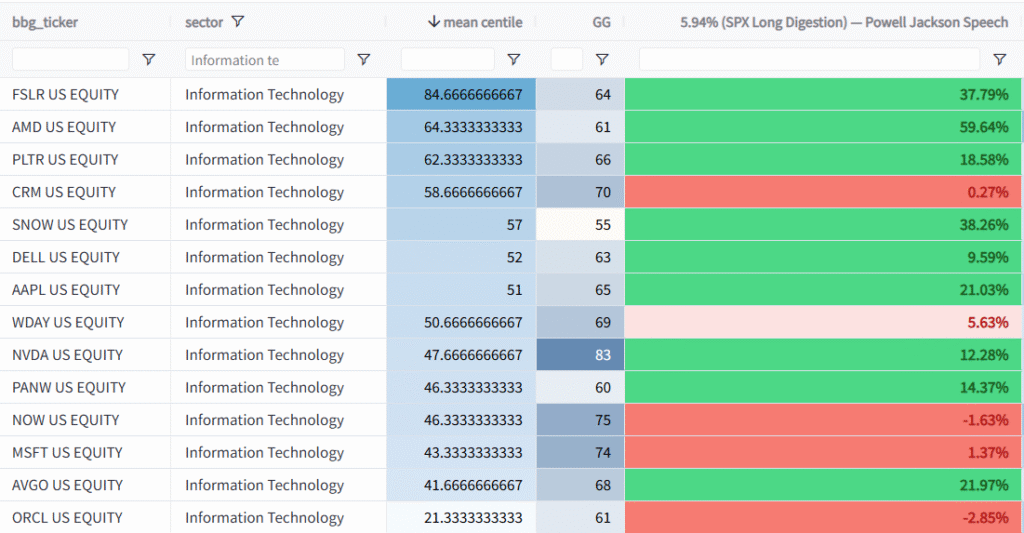

Growth Stocks Review

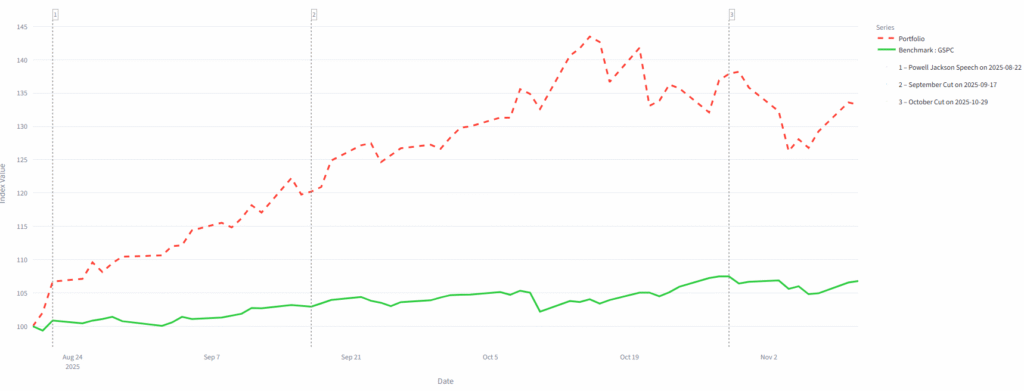

We can see a clear link between the mean percentile grade and the long digestion period since Powell’s speech. The top performer is AMD, driven by its deal signed with OpenAI to provide chips. PLTR, DELL, AAPL, NVDA, and AVGO also performed well in the portfolio, and we note that the chip makers in this group (AMD, NVDA, AVGO) were particularly strong. These are the same stocks that outperformed on the rate cut date. We can increase AMD and reduce AVGO.

Finally, we are seeing performance in customer relationships management stocks that can benefit from AI. CRM and SNOW outperform on most dates, whereas NOW lags behind, outperforming only around the September cut.

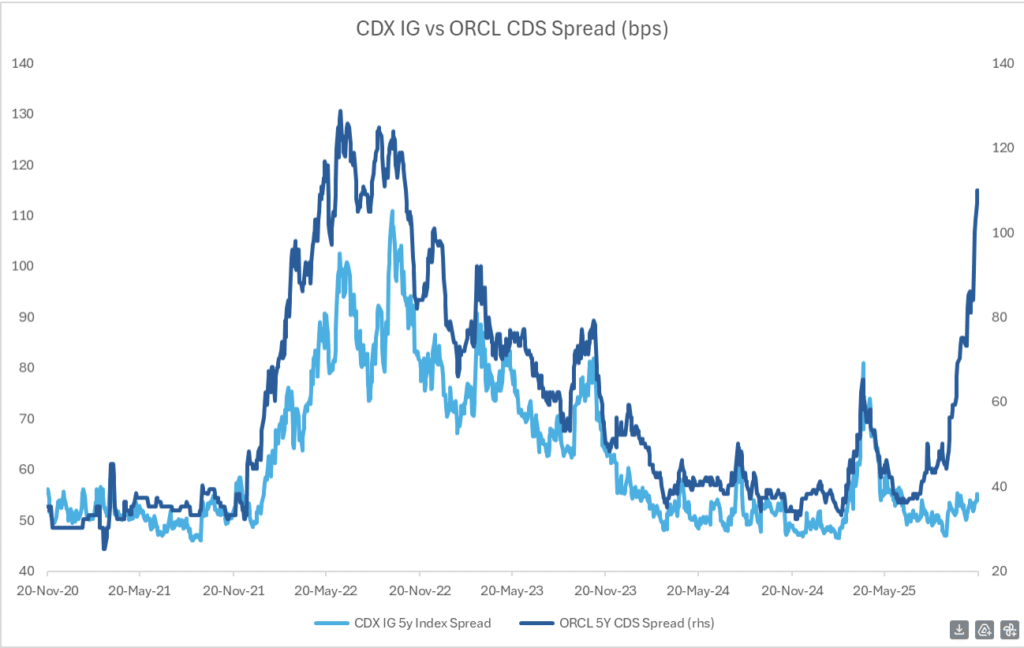

ORCL is becoming the new barometer for the AI franzy, its CDS have trippled since the OpenAI deal as you can see on the chart below:

Real Estate Review:

At first, on August 22, the homebuilders benefited from this rise, but that started to wear down in early September. There is not enough demand for new housing. People are starting to worry about their jobs, leading to very low sentiment and persistent inflation fears.

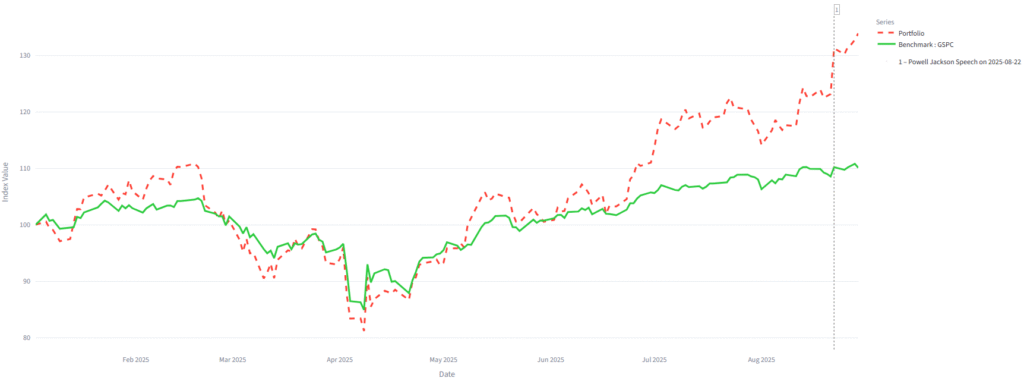

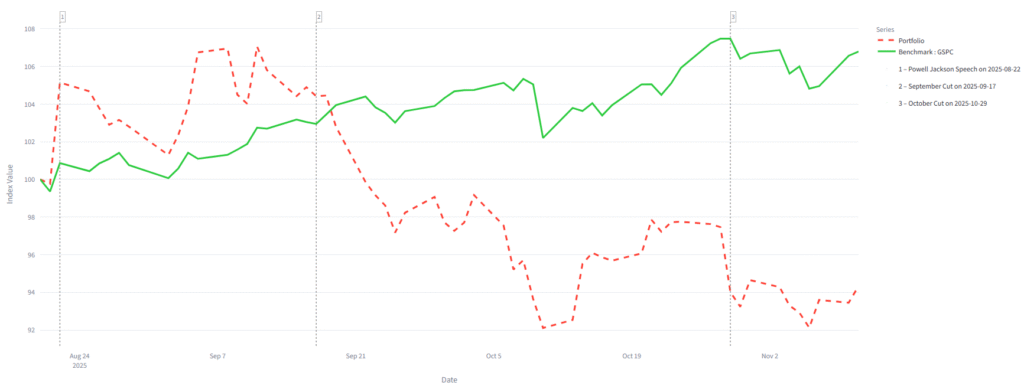

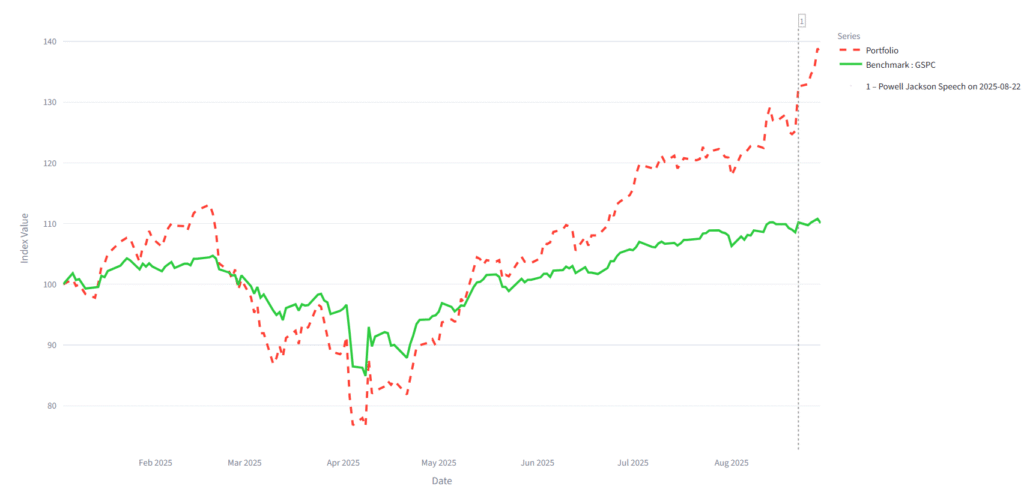

Below, you can see the basket identified on the day of Jackson Hole (August 22). It clearly outperformed the market on that date, but then around the implementation of the rate cuts, we saw a clear divergence. We initiated a short position in stocks like PulteGroup (PHM).

The sector fell, and the XLRE ETF lost 4.5% when Powell adopted his hawkish tone. This sector is demonstrating an asymmetric sensitivity, reacting more strongly to negative news than to positive catalysts.

Our Discretionary basket, presented in early October, showed clear outperformance following the Jackson Hole meeting.

However, approaching the anticipated September rate cut, the discretionary sector turned sluggish. The real economy appears hurt, with consumer confidence at its lowest point and worrying signs of inflation emerging. This is happening even though Powell stated in his last meeting that, if it were not for the tariffs, inflation would be at target.

We increase our short balance with discretionary name like ONON, SBUX ,GAP or NKE.

One of the clear winners identified in our ‘Fed-Independent Fractal’ was the mining industry

The miners have been carried by the rise of gold, which was driven mainly by China’s central bank but also by massive and constant inflows into ETFs. Separately, the growing, hard-to-tame tensions with China, especially regarding rare earths, pushed investors into the rare earth industry.

However, this trade is now fading. While gold itself has also decreased, we view this pullback as only temporary. We are nonetheless reducing our exposure by trimming positions in AGI and RGLD.

Fri. Aug. 22, 2025 – POWELL PIVOTS TO RATE CUTS

Fed Chairman Jay Powell opened the door to cutting rates in September. Powell was more dovish this morning, making it explicit that he does not want the labor market to weaken. Powell also adopted the view that tariffs could raise prices, yet that is likely to be short-lived and slow growth (i.e., Waller). Still, Powell did not fully pound the table on rate cuts largely because he sees the inflationary effects from circulating tariffs and urged caution. The odds of a Fed rate cut jumped from 60 to nearly 100 percent with stocks recovering half of their losses from this week.

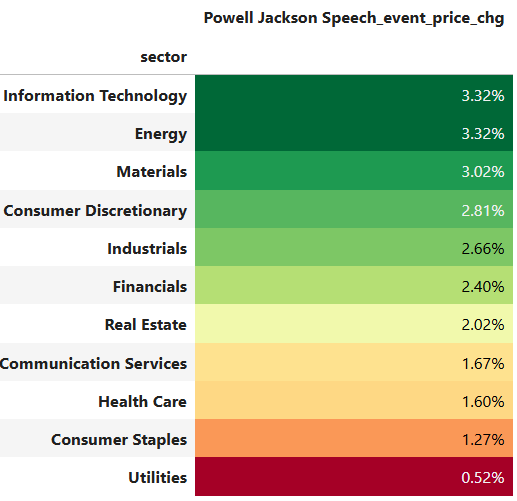

Looking at sectors daily returns, what went up the most are cyclical stocks, not defensives nemefitting from lower rates. This is a Summer market.

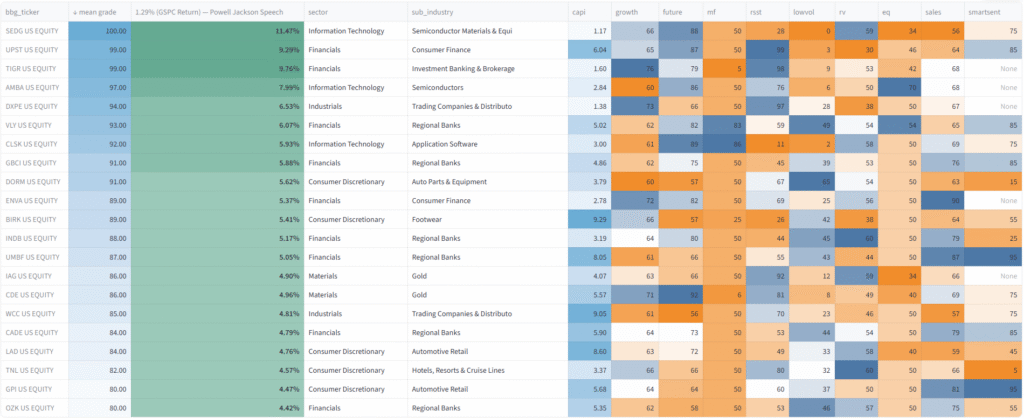

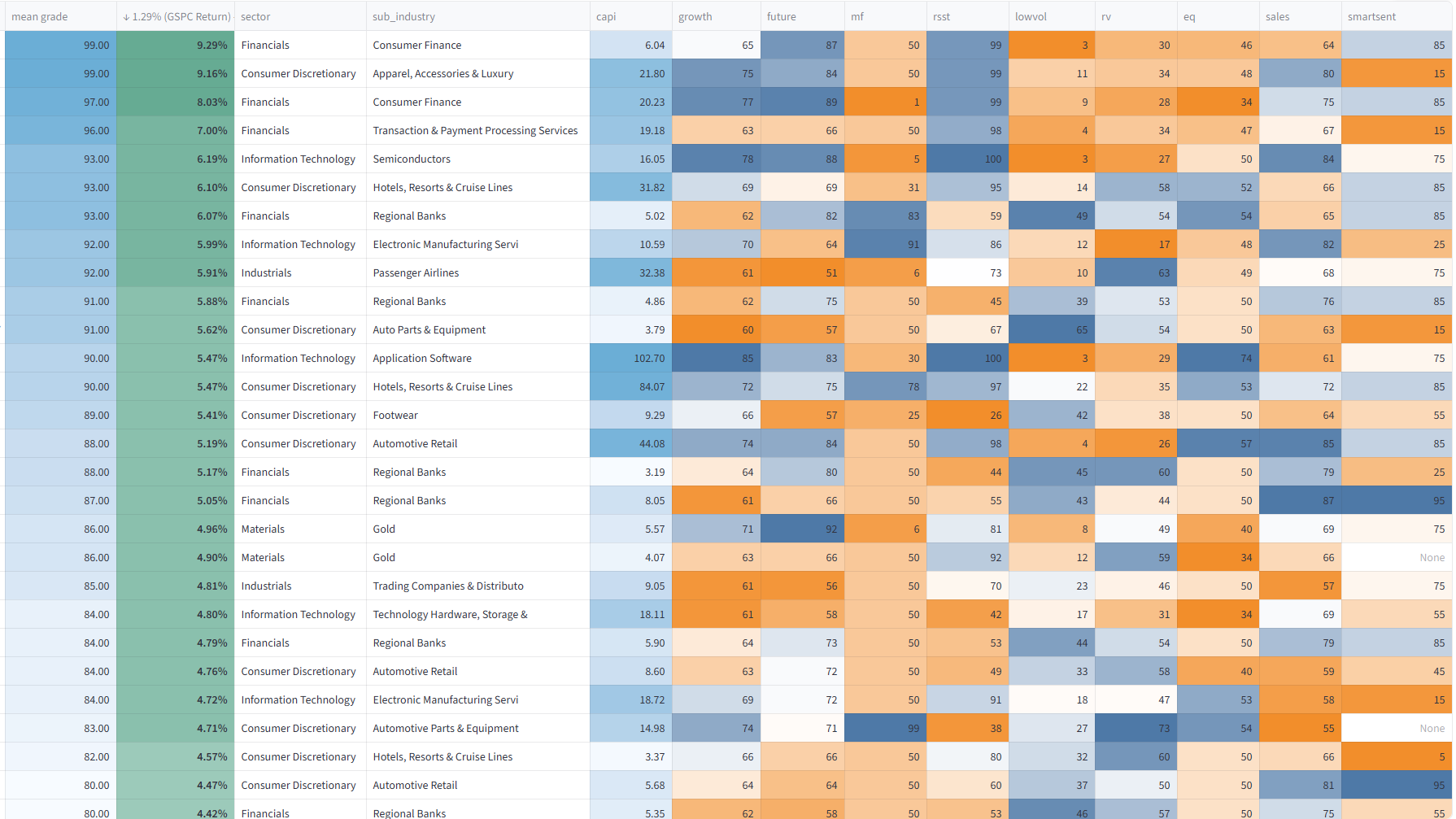

update August 26th – The fed-funds futures market (see chart above) was pricing in one and a third of cuts of a one-quarter percentage point each by year end, but After a dovish Jackson hole, nearly 2 rate cuts are priced, and 5.5 for the end of 2026, or -133 bps. We are updating our Inflation (now rate cuts denominated) fractal to study the impact of the (1) jackson Hole on stocks/ sectors. Here is a basket of stocks specifically benifitting from a coming rate cut on the right hand chart. Crossing that fracal with our best quantitative grades and in a regime like Summer with the EPS grade, the first ten names could be considered in our quantamental longs if we can buy them at the right price, like Eaton (ETN US), or FCX. META, AVGO, JPM, COF are already part of our US quantamental longs.

The Fed’s latest Summary of Economic Projections made the growing cracks even clearer. While the median forecast still shows two rate cuts this year, policymakers are split. Seven of the 12 voting members on the Federal Open Market Committee see no rate cuts at all. A handful want to move faster. And two of the loudest voices pushing for action, Vice Chair for Supervision Michelle Bowman and Gov. Christopher Waller, are Trump appointees. Waller’s name is being floated as a potential replacement for Powell when his term ends next spring.

Macro Analysis

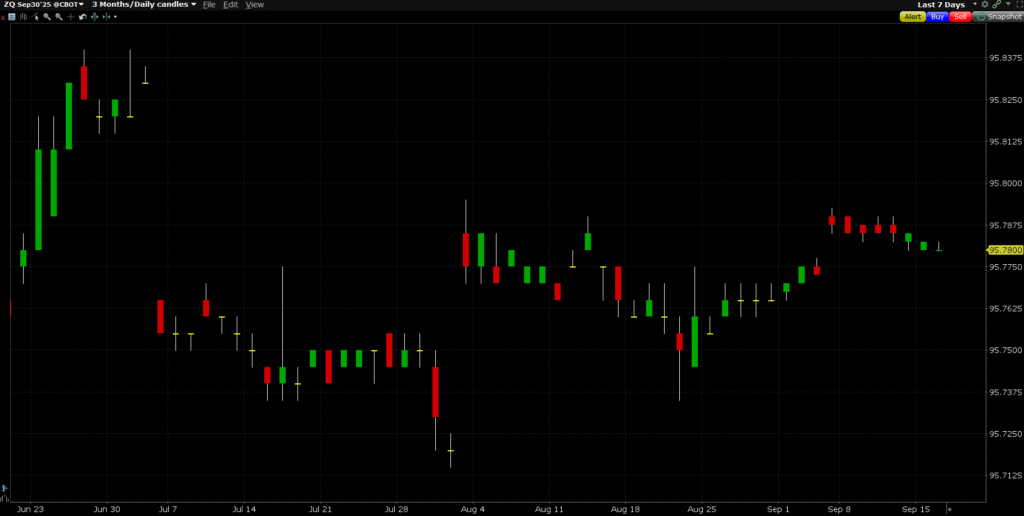

Markets are now heavily pricing in an interest rate cut at the September 16-17 FOMC meeting, as indicated by the Fed Funds Futures chart above. This sentiment is amplified by the ongoing “Trump-Cook saga,” which challenges the independence of the Federal Reserve and the American system of checks and balances.

The currently anticipated cut could be classified as unexpected. This is because, at the last meeting, Chairman Powell’s tone was more hawkish than anticipated, possibly as a way to stand firm against pressure from President Trump and assert the Fed’s independence.

The recent dovish tone from the Jackson Hole symposium was quite unexpected by the market, a shift confirmed by the bond market’s reaction. A key idea in monetary policy is distinguishing between the immediate interest rate target and the future path of policy. Currently, there is uncertainty surrounding both. If President Trump were to set the target, he might call for 300 basis points in cuts, which is an unrealistic scenario.

The 10-Year US Treasury Yield (USGG10YR) has fallen from 4.33% to 4.25% as shown in the graph above. A falling yield indicates that the bond’s price is rising, suggesting increased demand. This speach also push the front end of the curve lower more quicly that the 10 year. This movement has led to a steepening of the yield curve, which could result in a contraction at the front end and an increase at the long end—a potentially dangerous path for compagny depending on the high end of the curve with high finance linked to 0 yeards or more.

Ultimately, a weaker dollar combined with falling long-term interest rates points to a dovish surprise from the U.S. Federal Reserve. This suggests the Fed’s recent communications have been interpreted as less aggressive on inflation than investors had previously anticipated. This new perceived “path” for future policy makes holding short-term bonds less attractive, and the long end more attractive as investors seek to lock in a higher yield.

It is worth highlighting the recent surge in gold prices from $3,325 to $3,375. It raises the question of whether certain equity segments, particularly mining companies, could benefit from this development, even if only indirectly. At the same time, the simultaneous appreciation of both equities and a traditional safe-haven asset such as gold suggests a potential market distortion, unless the answer is a weaker dollar.

Outperformer Basket:

Small cap Basket: