The catalyst for the short is the US-China/Europe trade war: luxury names have not yet reacted to that headwind, like automobiles.

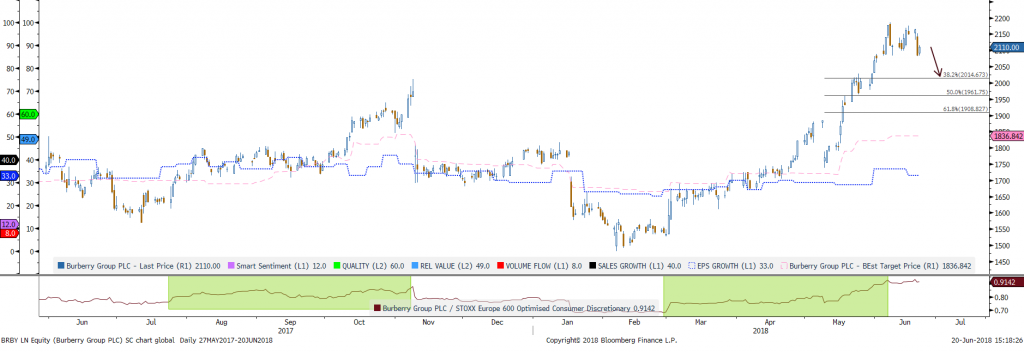

Burberry is the worst luxury European company based on our quant lab. Its Eps growth grade is bearish at 33, its smart sentiment is very bearish at 12, and its volume flow grade is very bearish at 8 (while the share price is not far from the top).

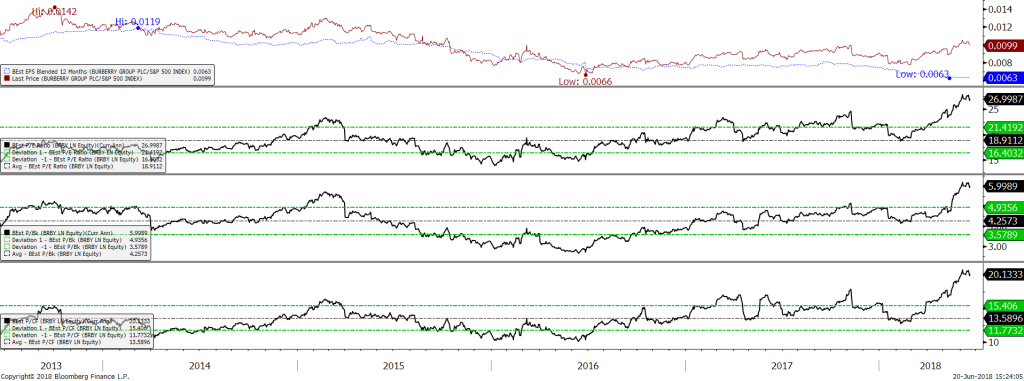

In terms of more long term factors, its valuation is over-extended (27 p/e versus 18.9 in average since 5 years)

Technically, the share price is topping after having reached a wave 3 target. We expect a consolidation towards 1960, which represents the wave 4 target and the lower band of the pirchfork channel.