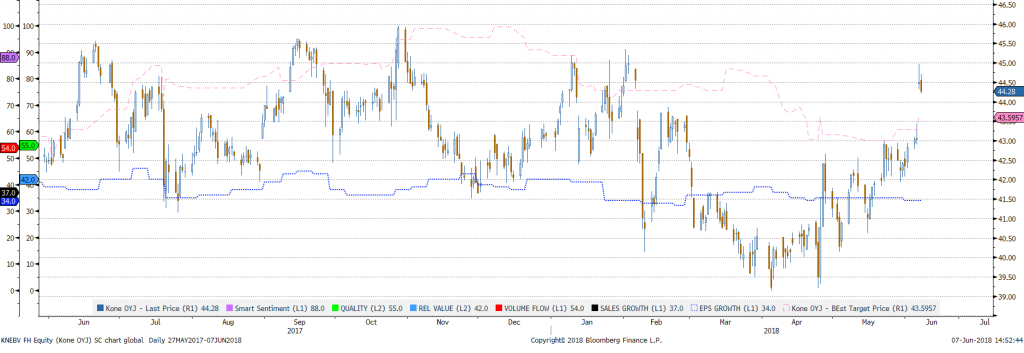

Short > 44.3 , target 42.75 , stop 45.65

Today GS is upgrading from Sell to Buy with a €50 12m PT (was €38). Post strong performance from 2009-14, when China construction (KONE’s main market, c.25% of sales) boomed, it has underperformed the sector (c.-34pp, 2015-present). They now expect this to reverse, as China to turn into a tailwind in 2018/19 and CROCI acceleration on China volume & cost savings.

Our quant robot respectfully disagrees and we recommend fading “pump up the jam” GS by shorting the stock above 44.3

Our quant robot respectfully disagrees and we recommend fading “pump up the jam” GS by shorting the stock above 44.3