january 14th, 2019: One of the sectors most vulnerable to price disruption is consumer staples. Consider Gillette, which continued raising prices for razors and blades. But at some point, even with innovation in the product, how many blades do you really need, and how much are you going to pay for them? In 2016, the consumer finally balked and many defected to alternative shaving-products companies. Gillette was then forced to lower prices instead of raising them, overturning decades of conventional wisdom around the pricing power of branded consumer-staples companies. The consumer-staples sector hasn’t prepared itself for the onslaught of price transparency in an online, digital, e-commerce world, which is the opposite of the bricks-and-mortar world in which one can price-discriminate by customer segment and distribution channel. The industry’s yesteryear playbook of relying on distribution strength, brand and pricing power, and customer segmentation is going to get upended. The market isn’t paying sufficient attention to this long-term risk. Because we all listen to Warren Buffett, who has been the North Star of investing for so long, and God bless him, we needed one. But we need to stop living off the past. The concept of consumer staples being great franchises with high-quality earnings and pricing power is well known and in the price of the stocks. As I said this morning, investing is about figuring out what is unexpected. Equity markets need to rethink the notion of risk in every sector. The consumer-staples sector is revered for its high returns but not feared for its high risk exposure—whether it’s disruption risk, valuation risk, or whatever. There is going to be a whole reset of risk premiums across these vectors. The less attention we pay to them, the more they will come back to haunt us.

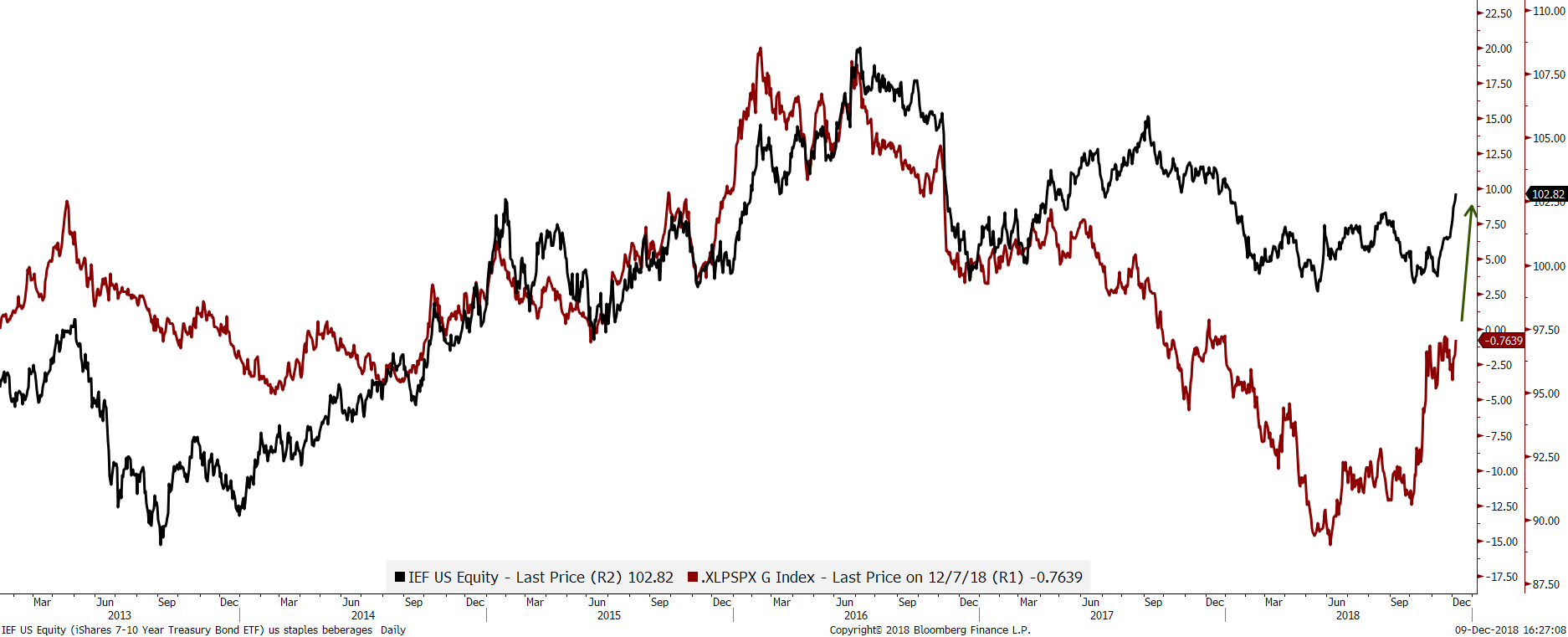

Staples should rise versus the S&P500 to catch the rising US bonds.