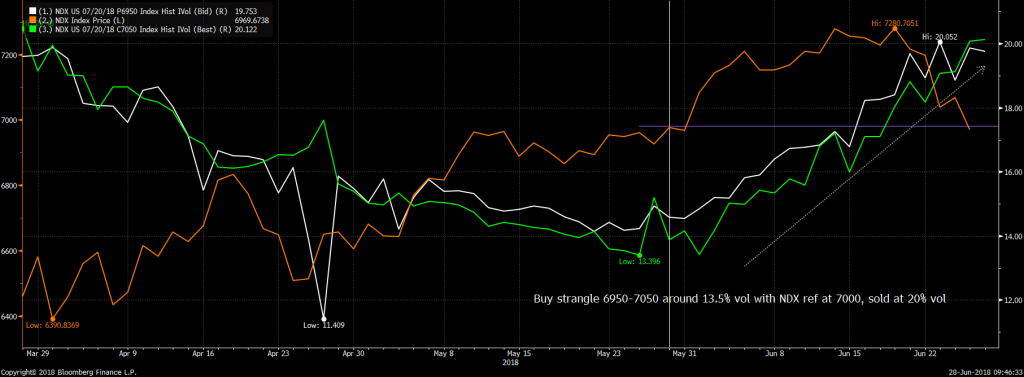

We initiated the following strangle on 30/05, to cope with more volatile markets

| July 7050 Call – 6950 Put |

and this what we got. We doubled the net premium invested while the strategy remained market neutral. We prefer closing that trade as the effect of time decay is going to be problematic now.

As a reminder, we increase our convexity weighting in volatile markets, but we cautiously wait for great entry levels on the vol. Our net premium as a pourcentage of the AUM should not exceed 4.5%. After the close of this NDX convexity, our net convexity premium invested is 1.06% of Nav.