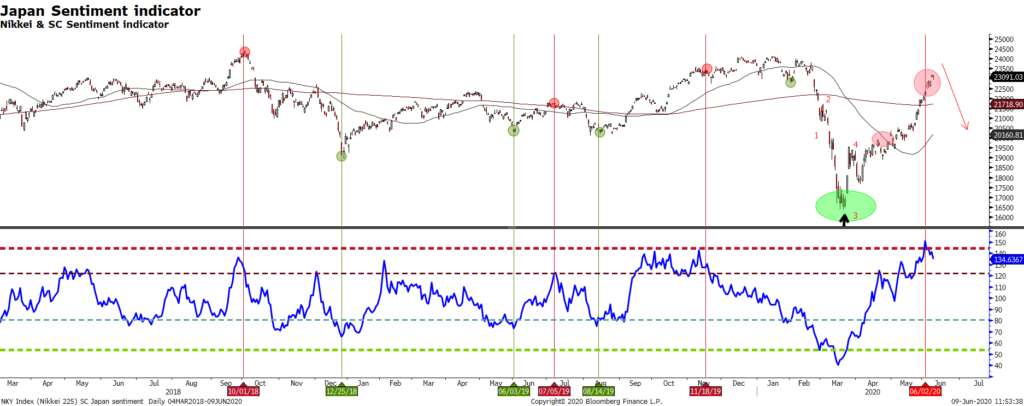

Our regional Matrix is underweight Japan. Our Japanese allocation has been overweight for the last 2 years, so we listen carefully to a change of tone from our matrix as: 1) Japanese stocks are not cheap anymore; 2) positioning and sentiment are bearish. We sell Nikkei as a tactical trade, as we do not expect a strong correction (thanks to supporting massive monetary and fiscal policy measures and a tepid COVID-19 second wave) but just a 5 to 9% drawdown which would represent the wave 4 of the current Elliott wave pattern. The chart below draws the Nikkei and SC japan sentiment indicator:

Source: Stouff Capital, Bloomberg

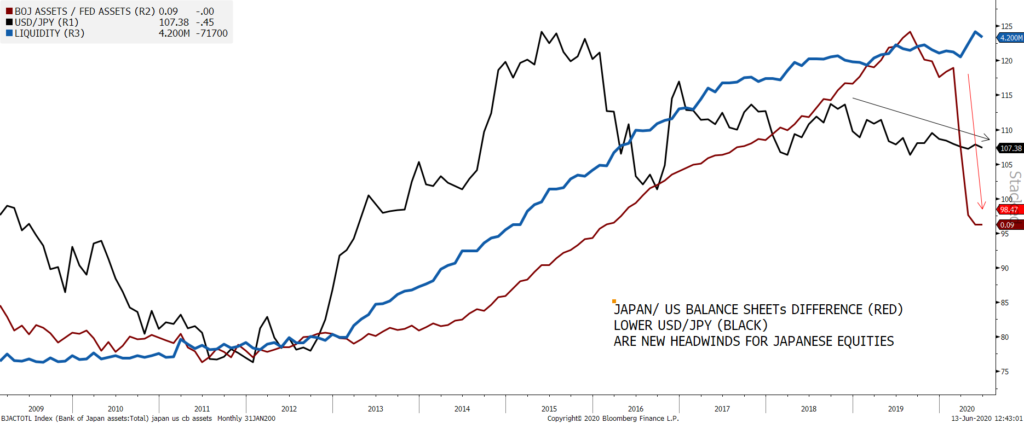

The chart below also shows that Japan is losing the pole position in terms of liquidity versus USA (red line is the spread between BOJ and Fed’s total assets). This is a relative negative.

Source: Stouff Capital, Bloomberg

Technically, the Nikkei has reached its bearish trend line since January 2020 at 23,200, which accidently or not represents the wave 3 extension from the elliott wave bullish pattern since the March low. The first leg (a) of the correction towards the 200 days moving average at 21,750 has already taken place, and a (b) rebound to 22,300 also, we now expect a steep correction towards 20,600.

Source: Stouff Capital, Bloomberg