Further Signals of More Accommodative Fiscal and Monetary Policies in China:

After some RRR cuts in 1H18 and allowing more flexibility for financial institutions to handle non-compliant WMPs, the authorities will now use fiscal policy tools to avoid a sharp slowdown in economic growth amid the tight credit environment. The statement from the State Council yesterday highlighted that the so-called “proactive fiscal policy” should be even more proactive. The policy signals in the past few days suggest that the authorities are trying to avoid a further slowdown in the growth of social financing in 2H18 to reduce the risk of large scale credit defaults.

Thus, following the close of our long put on EEM last week, we are adding a few Chinese names like:

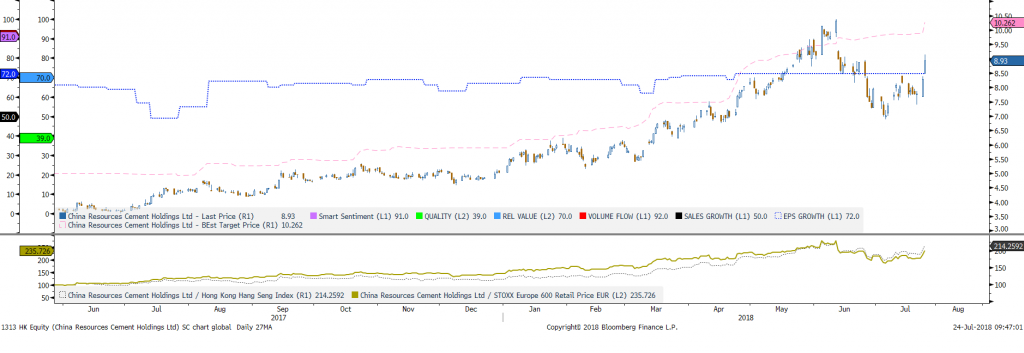

China Resources Cement – 1313 HK below 8.94 for a 10 target

Construction sector deserves a revisit. Concerns about financing for local government financing vehicles, including funding for PPP projects, led to a poor performance for the construction sector in 1H18 (down 18% based on the Hang Seng Large Cap Index; Figure 1). Clear policy support for infra-structure investment and local government financing vehicles should mitigate the concerns.

Agricultural Bank of China – 1288 HK below 3.83 for a 4.8 target

Sinopec – 386 HK below 7.4 for a 8 target